Lombard Launches its Public Beta: Reveals First DeFi Opportunities with LBTC

September 3, 2024

5 minutes read

Lombard, is pleased to announce its Public Beta launch after the successful completion of its Private Beta on mainnet, which attracted $230M (3930 BTC) in deposits from over 4,143 institutional and individual allocators. Lombard is also proud to unveil the first destinations where LBTC will connect Bitcoin to DeFi, become a core-primitive, and transform Bitcoin into an economically active participant in the trillion-dollar industry it started 14 years ago.

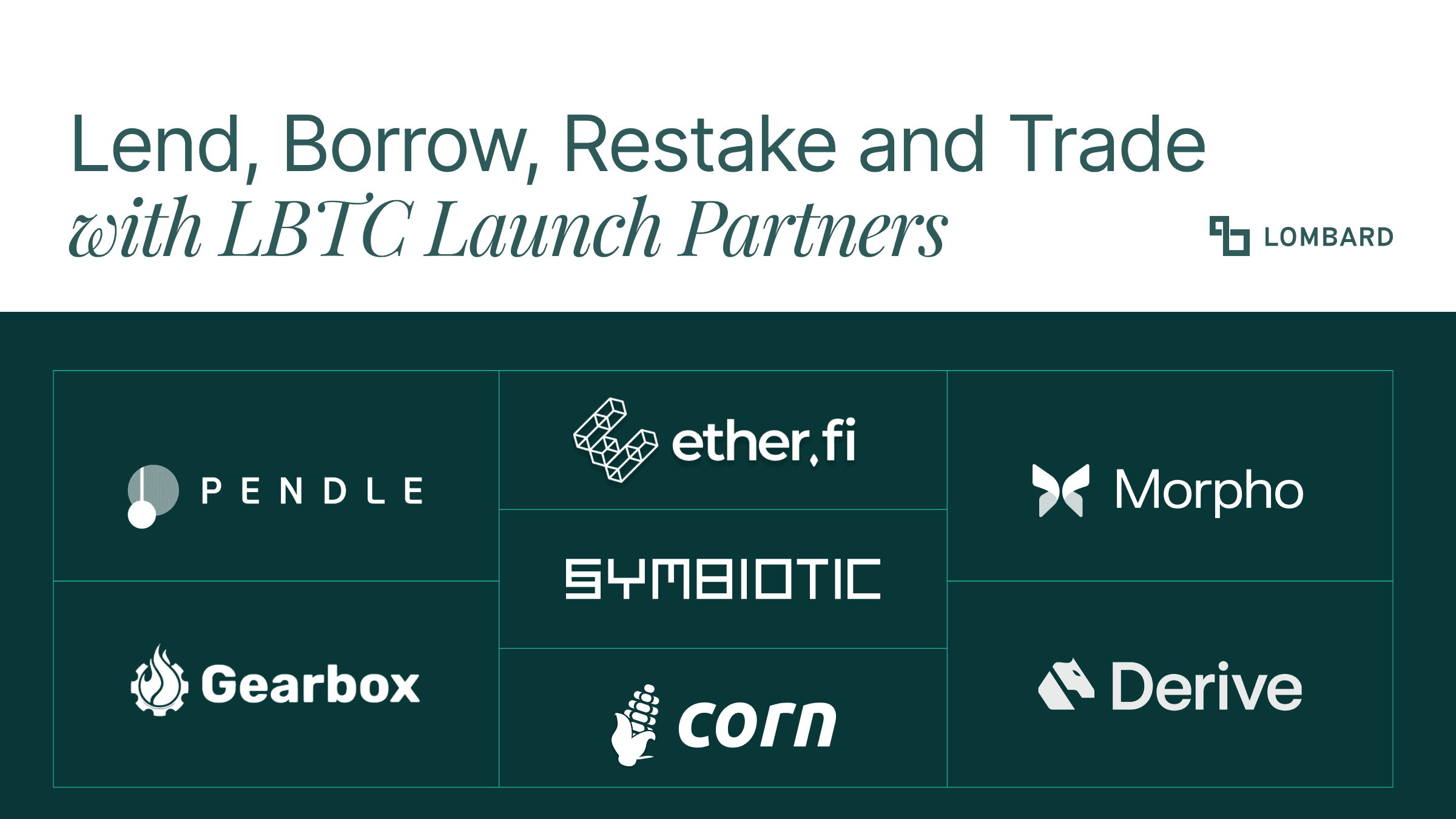

LBTC Integrations Across the Ethereum DeFi Ecosystem

Lombard is proud to launch LBTC with leading DeFi platforms Pendle, Morpho, Symbiotic, Gearbox, Gauntlet, Derive (formerly Lyra), Ether.fi, and Corn. These protocols currently manage $12 billion worth of assets and will incorporate LBTC for a wide range of use cases, including re-staking, lending and borrowing, options trading, and yield-farming.

The integrations will begin to launch this week, so users can immediately begin doing more with their Bitcoin. A quick overview of each integration is provided below, with full campaigns to launch once each integration is live. Turn X notifications on to be the first to know..

- Ether.Fi: EtherFi and Lombard will launch an exclusive partnership where LBTC will underpin all BTC-backed liquid restaking products available on EtherFi. This collaboration will return a basket of yields to stakers from EigenLayer, Symbiotic, Karak, and more, through a one-click experience.

- Symbiotic: Symbiotic will add LBTC as a collateral asset to meet the growing demand for Bitcoin in its ecosystem. A deeper collaboration will see Symbiotic and Lombard establish a robust, self-sustaining shared security market with LBTC actively participating on both the demand and supply sides.

- Morpho:Two new LBTC markets, curated by Gauntlet and Re7, will launch on Morpho. The vaults provide risk-adjusted, BTC-denominated yields to WBTC suppliers through over-collateralized lending in Morpho's permissionless and secure environment. LBTC on Morpho allows users to leverage their LBTC exposure.

- Gearbox: LBTC will be introduced to Gearbox’s ‘Leveraged Points’ product, enabling users to enhance their yield on LBTC through advanced automated looping strategies.

- Corn: LBTC will be integrated into Corn, an innovative Ethereum Layer 2 solution that uses BTC as gas. The integration will be phased, beginning with LBTC deposits into Corn Silos (vaults) on Ethereum, and eventually expanding to bridging LBTC to activate DeFi protocols on the Corn network.

- Pendle: Pendle will tokenize LBTC deposits made into Corn, allowing users to engage with these assets on the Pendle platform. Users will have access to fixed yields on their principal tokens, and leveraged positions to enhance exposure to rewards generated by LBTC deposits on Corn. These rewards include Lombard Lux, Corn Kernels, Babylon Points, and PoS staking yields.

- Derive (formerly Lyra): LBTC will be integrated into Derive, where automated complex derivatives strategies will soon be available to users. As Derive expands its BTC-denominated yield offerings, it will introduce a covered call spread vault for LBTC.

Lombard is driven by the fact that if just 10% of Bitcoin's market cap flows into DeFi, the total value locked (TVL) in the ecosystem could more than double, bringing new users, activity and volume to DeFi protocols, and catalyzing unprecedented growth. Because LBTC is permissionless, any DeFi platform can integrate it without requiring centralized approval.

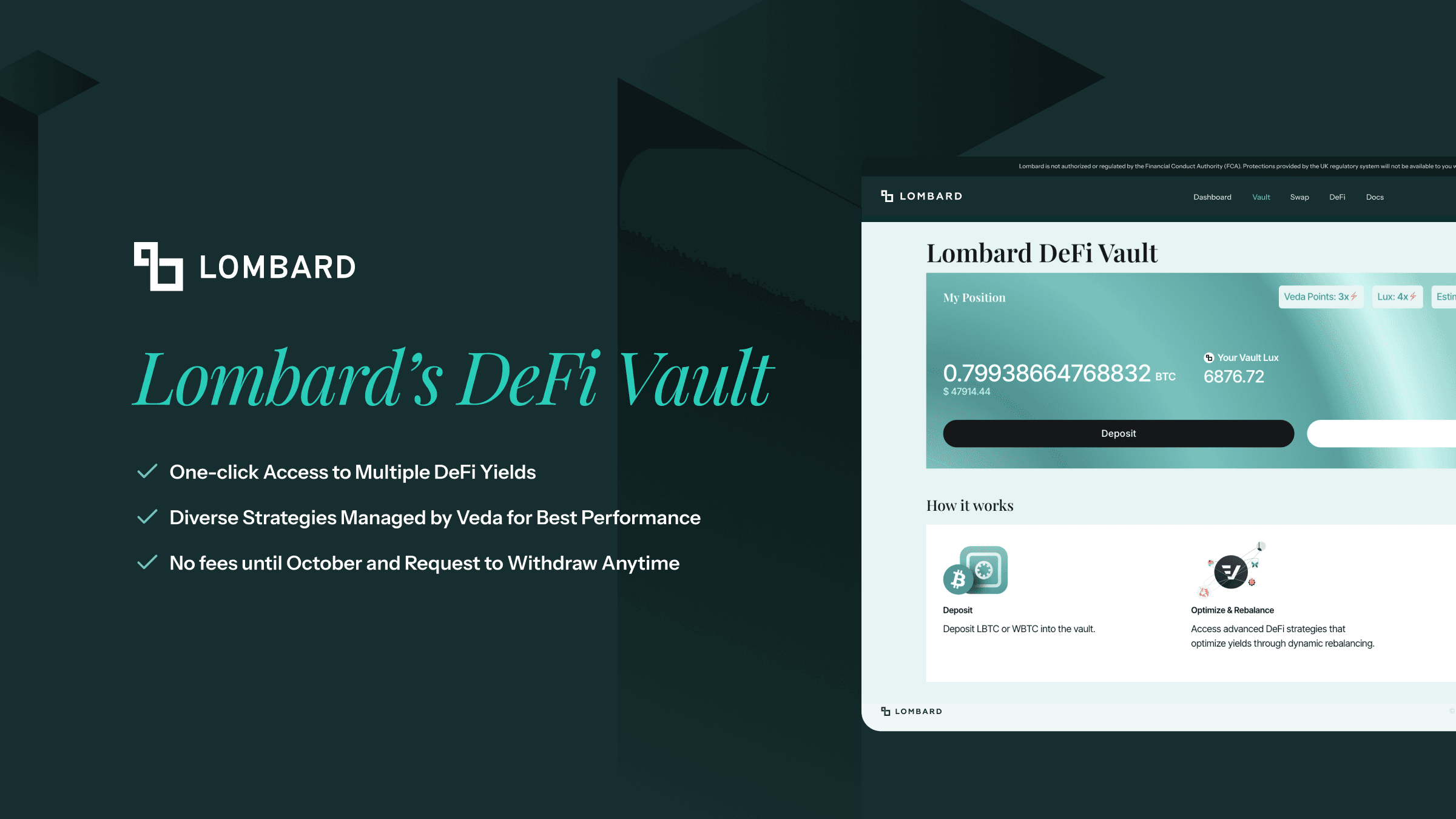

Lombard’s DeFi Vault: Simplifying DeFi Participation

Lombard is also unveiling the DeFi Vault, operated by Veda, designed to provide one-click access to DeFi yields. The DeFi Vault has been in operation throughout the Private Beta phase, amassing over $14.5 million in deposits.

Participating in DeFi can be complex, often requiring technical knowledge to select strategies and manage positions. The DeFi Vault simplifies this process by leveraging Veda’s expertise in tokenizing DeFi yields. The vault accepts both WBTC and LBTC, offering users access to a variety of DeFi strategies including Aave, Pendle, Uniswap, and others.

Read more in this blog post.

Access the DeFi Vault.

Check out our documentation.

LBTC: A New Era for Bitcoin in DeFi

LBTC is more than just a representation of BTC; it’s a liquid and yield-bearing asset that can move seamlessly across different chains and DeFi platforms as collateral, all without compromising security. Early traction tells us that LBTC is a universal Bitcoin primitive, valuable to every protocol, chain, and person with a stake in the digital economy.

Lombard has already begun staking users’ deposits into Babylon’s first mainnet cap, which in time will secure proof-of-stake (PoS) networks, allowing LBTC holders to earn a yield while remaining liquid for use across the DeFi ecosystem.

Lombard is implementing a phased rollout strategy to make LBTC widely accessible across the DeFi landscape. Initially, LBTC will launch on the Ethereum mainnet, where the majority of Bitcoin liquidity resides within blue-chip protocol partners like Ether.Fi, Symbiotic, Morpho, Pendle, Gauntlet, Corn, Derive, and Gearbox. Over the coming months, Lombard plans to expand LBTC’s reach to Ethereum Layer-2 networks, followed by integrations with innovative Bitcoin Layer-2s and next-generation blockchain networks.

Security at the Core of Lombard’s Vision

Security is Lombard's top priority. The platform’s unique Security Consortium ensures there’s no single point of failure, with multiple independent parties validating transactions on the Lombard protocol. This commitment to security and decentralization positions LBTC as a reliable and flexible tool for a wide range of DeFi applications.

For more information and to access LBTC, please visit Lombard’s WebApp.

Stay up-to-date with the latest developments by following Lombard on Twitter.