Lombard’s DeFi Vault: One-click access to DeFi Yields with LBTC

September 3, 2024

4 minutes read

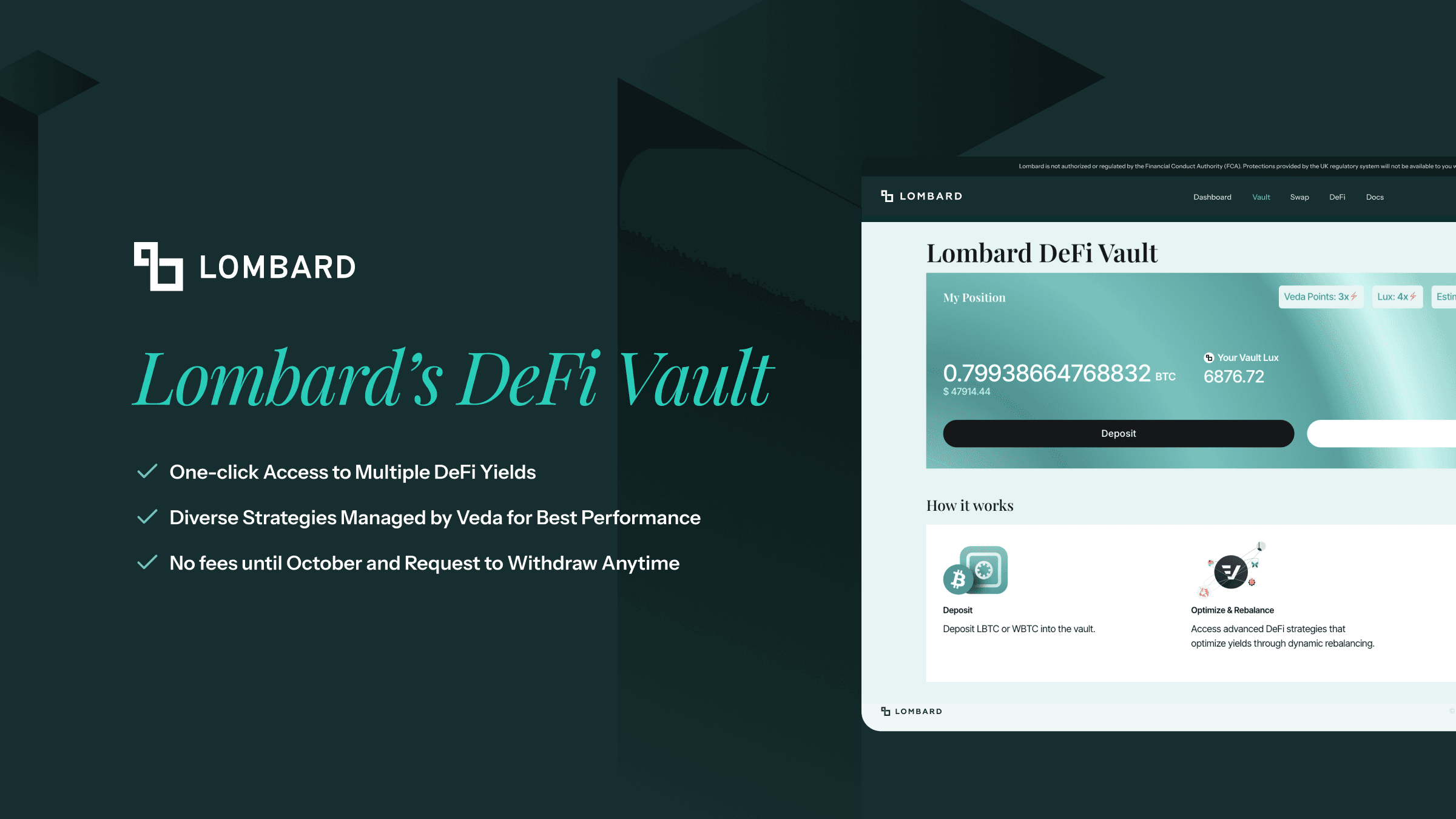

Lombard is pleased to introduce Lombard’s DeFi Vault, designed to bridge the gap between Bitcoin and DeFi, by offering LBTC holders one-click access to DeFi yields without any of the complexities. The DeFi Vault has been in operation throughout the Private Beta phase, amassing over $14.5 million in deposits in 10 days.

DeFi participation can be complicated. That’s why Lombard’s DeFi Vault aims to simplify the DeFi experience and remove the technical barriers of selecting strategies and managing positions. Instead, it relies on Veda’s ability to tokenize DeFi yields to power the offering. Users benefit from a range of DeFi strategies that deliver yield on LBTC, further enhanced by incentives from both Veda and Lombard.

Lombard’s DeFi Yield Vault aims to provide the most friction free access to DeFi yields on Bitcoin. It accepts WBTC and LBTC, a liquid staked token representation of Bitcoin, and seeks to capture the best opportunities across multiple DeFi strategies. LBTC enables Bitcoin holders — whether individual or large institutions — to fully engage in DeFi by leveraging their assets, without compromising on Bitcoin's inherent value.

Lombard’s DeFi Vault: Key Features

-

Effortless Access to DeFi Yields: LBTC holders can access DeFi yields with just one click within the WebApp. Lombard’s DeFi Vault eliminates the technical barriers and complexities typically associated with DeFi.

-

Diversified Strategies for Optimized Yields: Lombard’s DeFi Vault relies on various strategies, including providing liquidity on Curve, Uniswap, Morpho, Pendle, and more. By leveraging multiple DeFi strategies, Lombard’s DeFi Vault ensures that yields are not overly reliant on a single source. This diversification helps mitigate risks and enhance performance.

-

Attractive Initial Incentives: To make the experience even more rewarding, Lombard’s DeFi Vault offers initial incentives from Veda and Lombard.

-

Risk Profile: Price risk is mitigated by exclusively accepting BTC-backed assets and engaging in BTC-denominated strategies only. The initial set of strategies will focus on liquidity provision, fixed-yield farming, and capitalizing on market inefficiencies.

About Veda

The vault is developed in collaboration between Lombard and Veda. Veda is a native yield protocol that tokenizes yields, making them more accessible to users. With over $1 billion in TVL, Veda serves as a core infrastructure partner for Ether.fi.

This success is driven not only by a rigorous security approach, but also by deep integrations with protocol partners like Ether.Fi and a rich ecosystem of yield sources, including Aave, Pendle, Uniswap and others. Veda’s credibility and effectiveness in the DeFi space are reflected in its rapid growth and substantial TVL.

Finer Details

- Yield: DeFi yields are automatically converted into LBTC and accumulate directly within the Lombard DeFi Vault, allowing users to benefit from continuous growth.

- Fees: Enjoy fee-free access until the 1st October 2024. After that, a competitive 1.5% annual management fee is applied. The pro rata fee is deducted periodically (typically once per day) when Lombard’s DeFi Vault rebalances its position.

- Withdrawals: Withdrawals can be initiated anytime, with LBTC redeemable within 3 days.

- Additional Rewards: Depositors receive 4x Lombard Lux, 3x Veda Points, and Babylon Points.

How to Access

1. Get LBTC from Lombard

- Either swap any ERC-20 to LBTC using the Swap function

- Or, stake BTC and Mint LBTC from the Dashboard

2. Deposit LBTC or WBTC into Lombard’s DeFi Vault

Lombard Lux will be displayed on the DeFi Dashboard within the Lombard WebApp. Users can simply connect a wallet and navigate to the designated section to view accruals in real-time.

Eligibility

Participation is restricted for users in certain jurisdictions, including the United States.

Risks Disclaimer

Lombard DeFI Vault is composed of a diverse range of DeFi products, each carrying inherent smart contract risks and varying levels of economic risk. Users should be aware that these risks can impact both the principal and yield. It is essential to carefully assess the risk tolerance before participating in the vault.

Legal note

Lombard Lux are not, and may never convert to, accrue to, be used as basis to calculate, or become any tokens or other digital assets. The Lombard Protocol restricts access to users in certain jurisdictions, including the United States. For a full list of restricted parties, please visit our Terms of Service.