Lombard’s Vault products offer seamless access to actively managed DeFi strategies—delivering yield and ecosystem incentives without manual tracking or rebalancing positions.

What Are Vaults?

Vaults automate LBTC deployment across DeFi, optimizing for APY, ecosystem rewards, and strategy diversification with a single deposit. Read more on LBTC:

Each vault manages:

- Strategy selection

- Cross-chain execution

- Real-time rebalancing

- Aggregation of staking and protocol incentives

Lombard’s vaults are build for scale, but designed for simplicity. Explore vaults: https://www.lombard.finance/app/vaults/

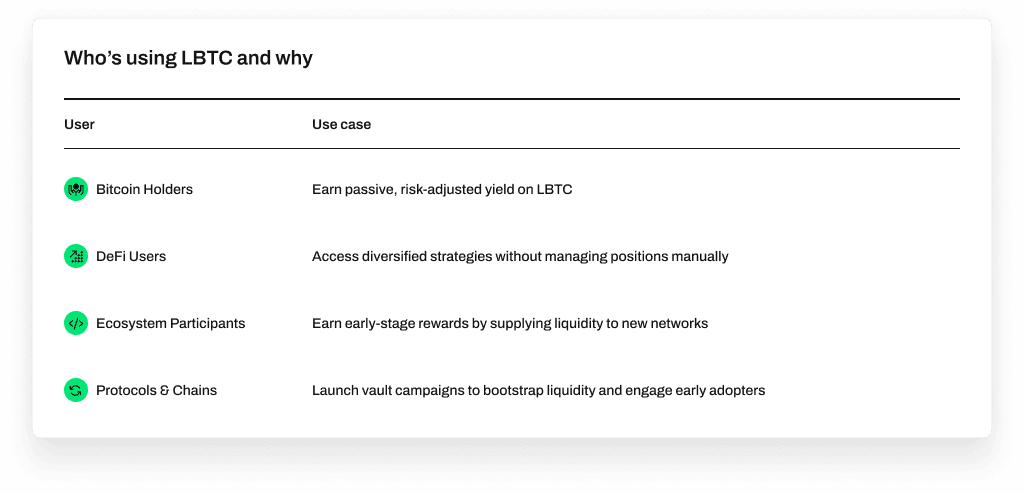

Who Are Vaults For?

Lombard Vaults are built for those ready to activate Bitcoin.

Whether optimizing for yield or driving ecosystem growth, Vaults are the gateway to making LBTC productive.

Whether optimizing for yield or driving ecosystem growth, Vaults are the gateway to making LBTC productive.

Types of Vaults

Vaults are split into two core categories—each designed to match different objectives for LBTC holders:

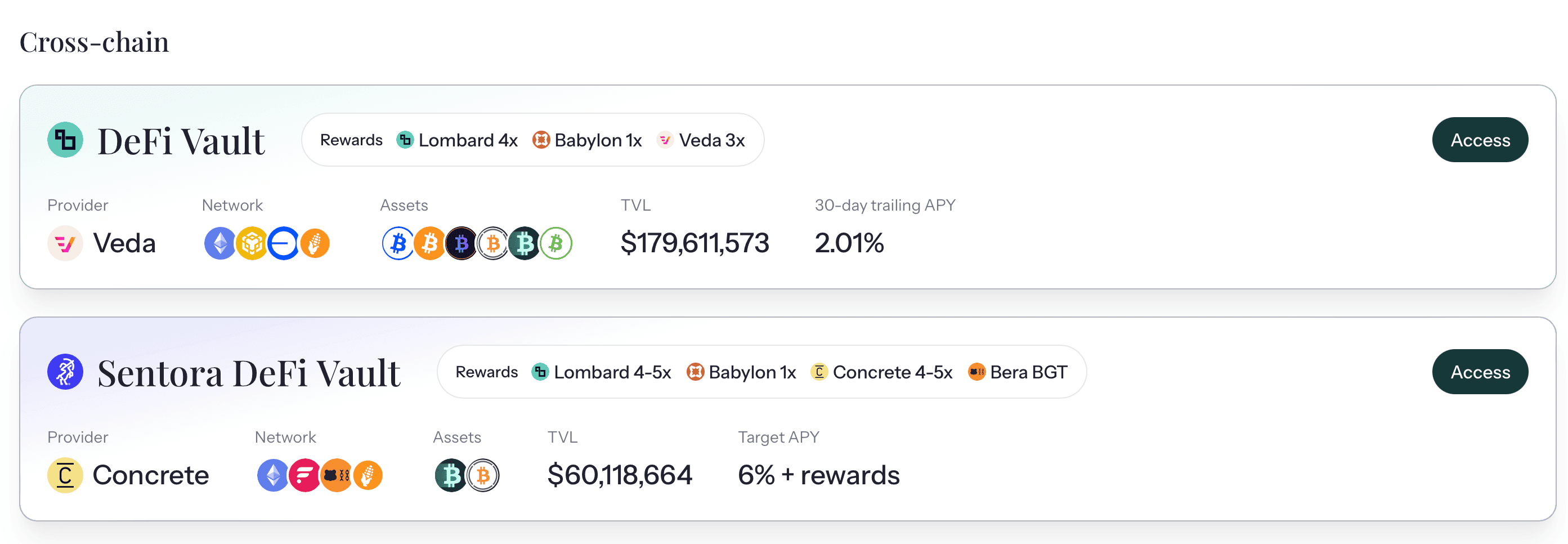

Cross-Chain Vaults

For sustainable yield, strategy execution, and long-term positioning

Cross-Chain vaults automate LBTC deployment across trusted DeFi venues like Curve, Spark, and Uniswap—maximizing risk-adjusted yield through rebalancing and protocol integrations.

-

DeFi Vault (Veda):

2.01% APY, with integrated DEX liquidity and active strategy management

-

Sentora Vault (Concrete):

6%+ APY, plus additional rewards from participating protocols

Ideal for BTC holders seeking steady returns across DeFi ecosystems.

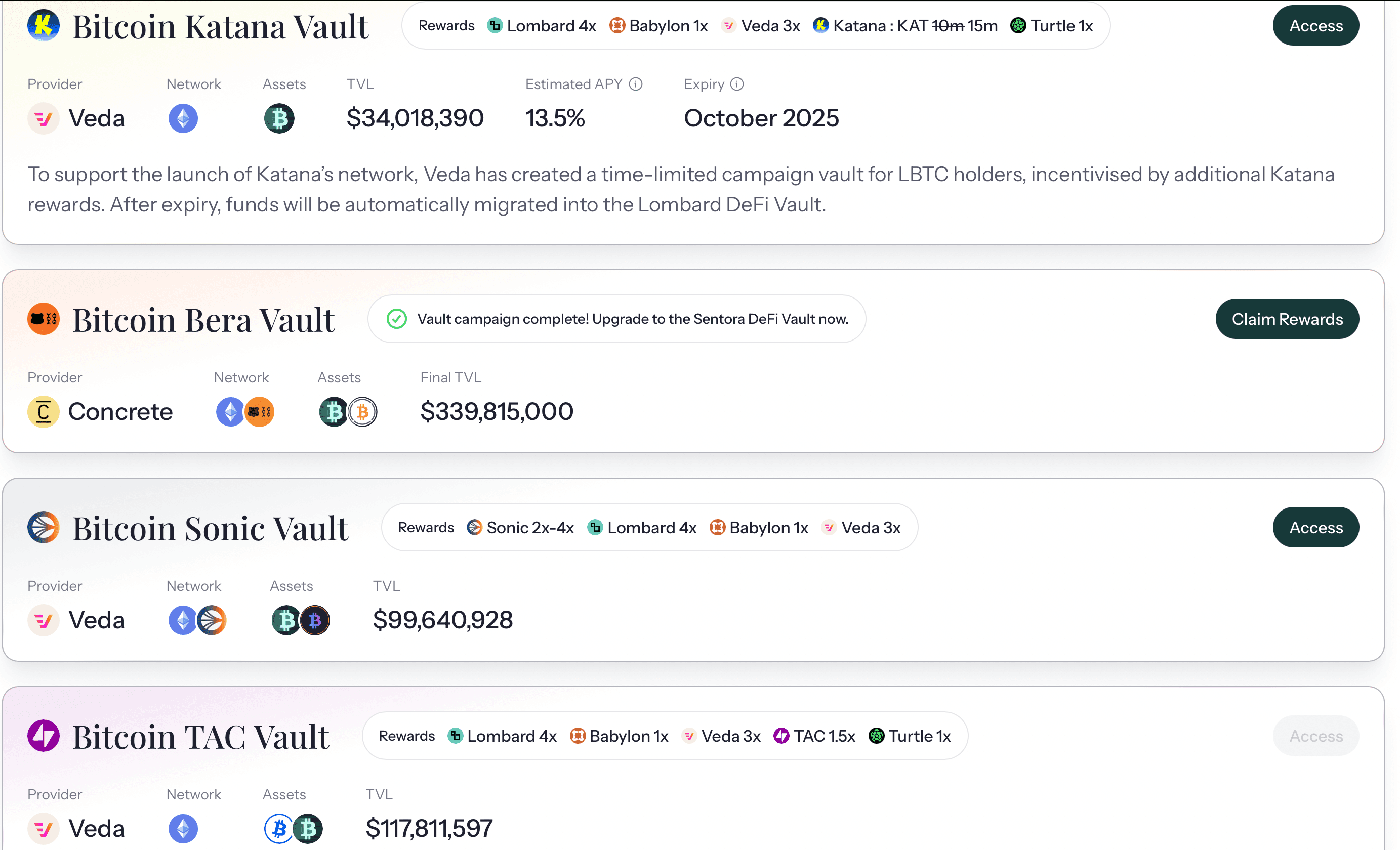

Ecosystem Vaults

For participants seeking early-stage incentives from new chains

Ecosystem vaults deploy LBTC to support emerging networks like Berachain, TAC, and Sonic—driving liquidity at key launch phases. In exchange, participants earn ecosystem incentives such as points, airdrops, and native tokens. These vaults are high-upside, incentive-rich opportunities designed for users optimizing for growth and early access.

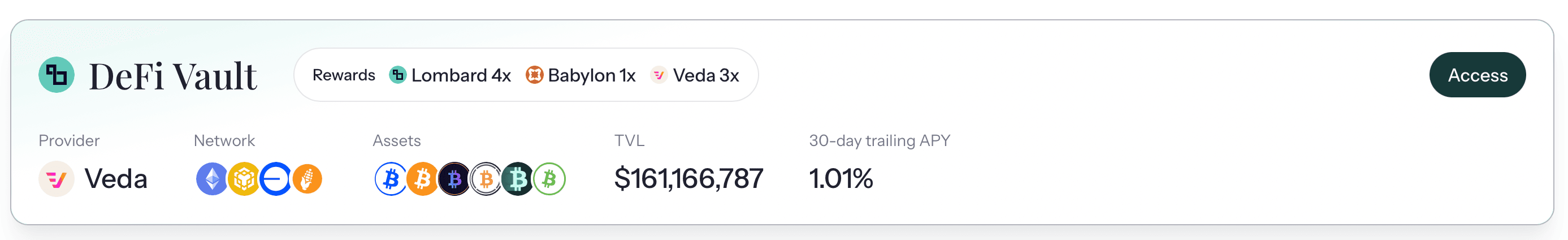

How Lombard’s DeFi Vault Lead to 1,000+ BTC Deployed Across Binance and Bybit

By integrating Lombard’s DeFi Vault via the LBTC SDK, Binance and Bybit unlocked native Bitcoin staking for their users—driving over 1,000 BTC in deposits within weeks.

Built on Veda’s yield infrastructure, the vault automates LBTC strategies across trusted DeFi protocols like Curve and Uniswap. With smart rebalancing, on-chain capital constraints, and cross-chain execution, it offers BTC holders a seamless way to earn without compromising security or composability. Read more about the DeFi vault: https://veda.tech/blog/lombard-launch

Today, the vault holds $161M+ in TVL, delivering over 2% APY.

How The Vault Works

- Stake BTC → Mint LBTC via the Lombard App

- Select a Vault suited to yield or incentive goals

- Deposit LBTC (or a compatible BTC derivatives)

- Vault executes strategies across integrated DeFi protocols

- Monitor rewards in the DeFi dashboard

- Withdraw anytime—capital and rewards remain accessible

Launch a Vault with Lombard

Lombard’s modular vault platform enables partners to design and deploy custom strategies that plug directly into LBTC capital flows.

→ For new chains: Bootstrap liquidity by launching an Ecosystem Vault that routes LBTC into pre-launch or early-stage incentives.

→ For asset managers and strategists: Deploy active DeFi strategies using LBTC as base collateral—gain access to distribution, user flow, and reward multipliers.

→ For DeFi protocols: Offer LBTC-native strategies directly in-app by integrating Lombard Vaults via the SDK.

Ready to launch?

→ Explore Vaults: https://www.lombard.finance/app/vaults/

→ Read the Vault docs: https://docs.lombard.finance/lbtc-liquid-bitcoin/defi-vaults