Lombard Partners with Cap and Symbiotic to Secure Institutional Credit with LBTC

October 9, 2025

3 minutes read

Lombard has partnered with Cap, a stablecoin protocol on Ethereum, to introduce a new application for LBTC, Lombard’s yield-bearing Bitcoin.

Through this partnership, restaking LBTC serves as credit default swaps for Cap’s institutional USD loans — allowing Bitcoin holders to earn additional yield from credit spreads while strengthening the foundation of onchain capital markets.

The integration is live via Symbiotic, where LBTC can be restaked into Cap’s shared security market — connecting Bitcoin directly to stablecoins and institutional lending.

About Cap

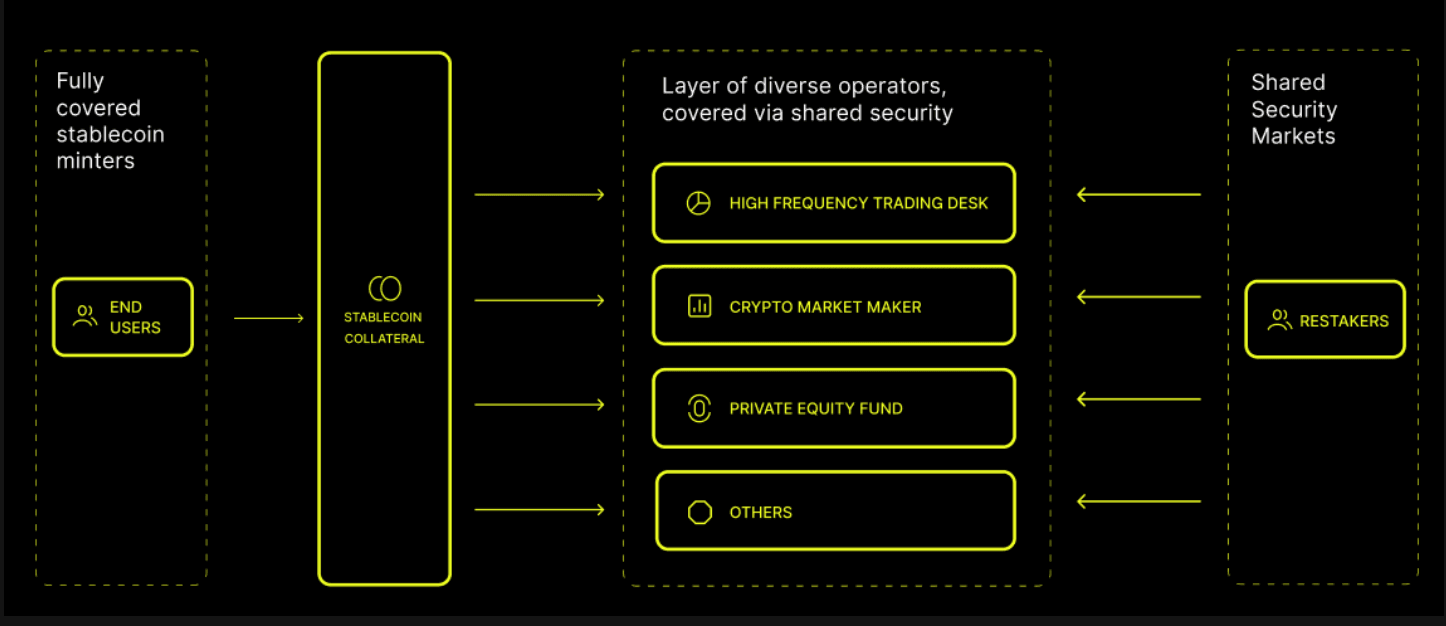

Cap is a stablecoin protocol on Ethereum designed to bring institutional-grade yield strategies onchain. It issues cUSD, a fully collateralized digital dollar redeemable 1:1 for USDC, and autonomously allocates it to institutional borrowers through a shared security model. cUSD holders can earn this insured institutional yield by staking into stcUSD.

The protocol enables vetted institutions—such as funds, trading desks, and market makers—to borrow stablecoins without posting collateral. These loans are insured by restakers, who provide decentralized coverage by delegating capital to backstop borrower activity. In return, LBTC holders share in the US dollar premium generated by these loans.

How this partnership works

Through this partnership, LBTC restakers take on the role of default insurance providers within Cap’s ecosystem for the institutions they choose to back. LBTC restakers can delegate their assets to Cap’s shared security market on Symbiotic, where they backstop individual institutional loans:

- Borrowers pay a fixed premium to restakers for underwriting their loans, which is set by both parties in bilateral negotiations. These fees are accrued every block in USDC, adding new BTC yield on top of native staking rewards.

- If a borrower defaults, the restaked LBTC that underwrites that borrower’s credit line absorbs the loss.

For example: Hyperithm, one of Asia’s leading digital asset managers, is the first operator to participate in this integration. The collateral backing cUSD is lent to Hyperithm, who deploy it to run onchain strategies. To have their loan underwritten, Hyperithm pays a 4% restaker fee to LBTC restakers, who provide insurance coverage by backing the loan with their restaked LBTC.

If Hyperithm were to default or fail to repay, the restakers’ LBTC delegated to that credit line would be slashed, covering the loss and protecting stablecoin holders. In this model, LBTC functions as active insurance collateral that secures institutional lending — marking a key step in connecting Bitcoin to the foundation of onchain credit markets.

Access the Hyperithm-LBTC market: https://app.symbiotic.fi/vault/0x3D5ccDE8E2fb939B36f2234AD4A93a455276a223

A Step Forward for Bitcoin Capital Markets

This partnership demonstrates how Bitcoin can move beyond passive yield and become a core security layer for onchain finance.

- For Institutions: Access to scalable, uncollateralized stablecoin credit that’s transparently insured by restaked BTC.

- For LBTC Holders: Additional BTC yield derived from institutional borrowing fees.

- For the Ecosystem: A decentralized alternative to centralized credit infrastructure where stablecoin and lending markets are secured by Bitcoin itself.

LBTC does not just earn yield, it powers stablecoins and institutional credit through restaking, creating a new foundation for transparent, scalable financial systems built on Bitcoin.