Lombard: Full-stack Infrastructure Bringing Bitcoin to Life Onchain

July 17, 2025

9 minutes read

Bitcoin is the most important asset of our generation.

Bitcoin started it all—the world’s hardest money that reimagined global finance built upon mathematical guarantees, not trust in people.

Bitcoin inspired a $trillion+ ecosystem of blockchains and onchain financial applications. Sixteen years later, DEXs are beginning to rival CEXs, stablecoins outcompete traditional payment networks, every asset is being tokenized, and the largest financial institutions now participate onchain.

Onchain finance is the future of finance.

The paradox: Bitcoin barely participates in the onchain revolution it sparked.

Bitcoin is idle in every sense. The vast majority of BTC sits in cold wallets, the blockchain remains isolated from all others, and the ecosystem sees limited innovation.

This represents $trillions in unrealized opportunity. As BTC sits idle, the digital economy built around Bitcoin remains dormant.

Lombard is here to change this. Legacy finance was built on gold. Modern (onchain) finance will be built on Bitcoin.

Lombard’s Evolution: From Protocol to Platform

Today, we're announcing Lombard's vision to build Bitcoin Capital Markets onchain. This is the natural next step towards what we've been building toward since day one.

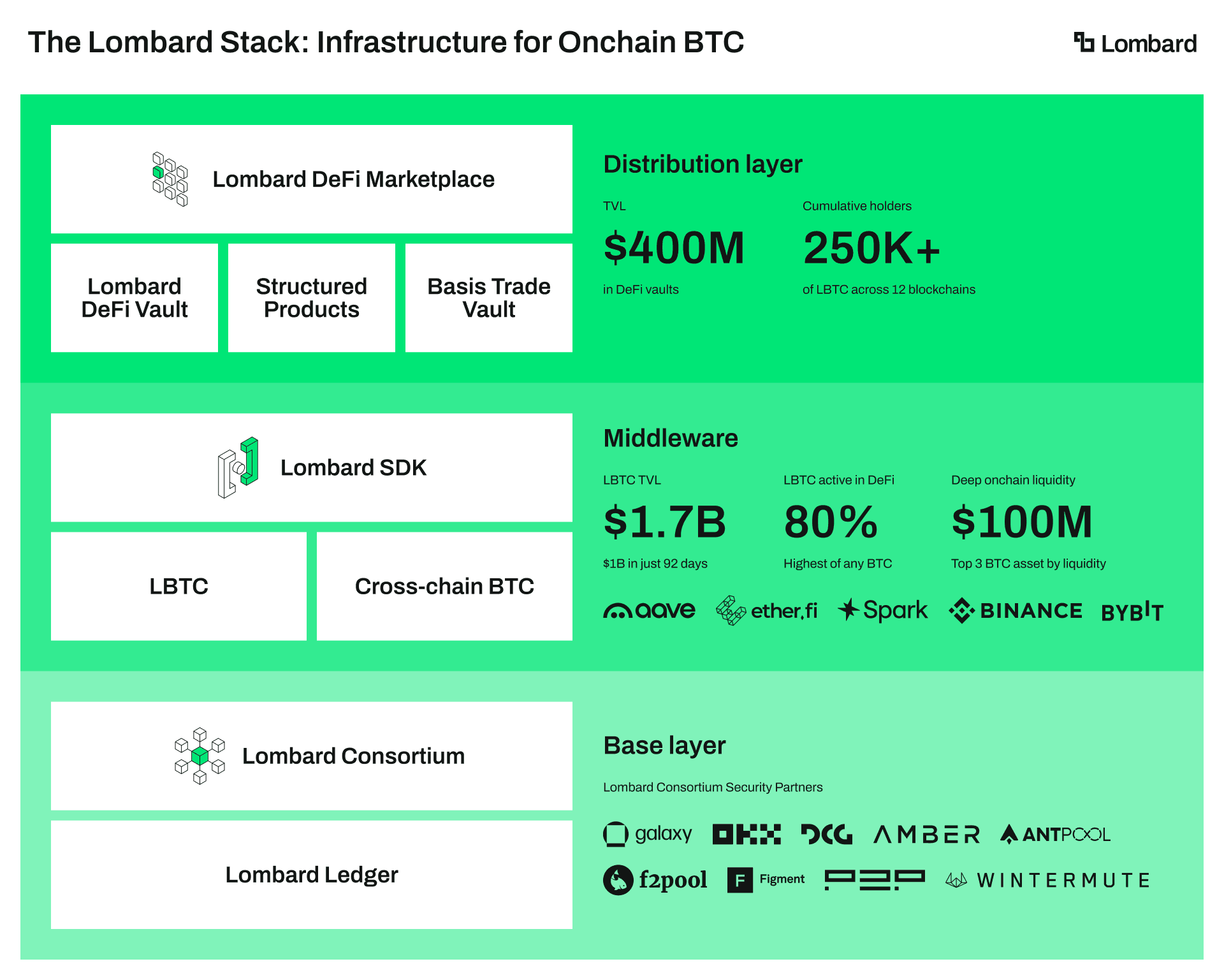

We started with a simple insight: Bitcoin needs to move to unlock its true potential. We built a simple, unified product, LBTC, that took the market by storm. In the process, we built multiple pieces of core Bitcoin DeFi infrastructure, each with the potential stand alone product.

Lombard has evolved into a dynamic, full-stack platform to support the development of onchain Bitcoin Capital Markets and the next generation of innovation on Bitcoin.

Lombard will be the driving force for growing the onchain Bitcoin economy.

Lombard has evolved into a dynamic, full-stack platform to support the development of onchain Bitcoin Capital Markets and the next generation of innovation on Bitcoin.

Lombard will be the driving force for growing the onchain Bitcoin economy.

Building Bitcoin Capital Markets is the next step to making this a reality.

Bitcoin Capital Markets

Capital markets are the engines of economic progress. They serve as the foundation upon which all forms of financial applications are built, and provide the resources necessary for builders to start and scale businesses. To enable innovation onchain, we must first build liquid capital markets.

Despite being the first crypto asset, Bitcoin still lacks the liquid onchain market infrastructure needed to give it true utility and velocity — but this is changing!

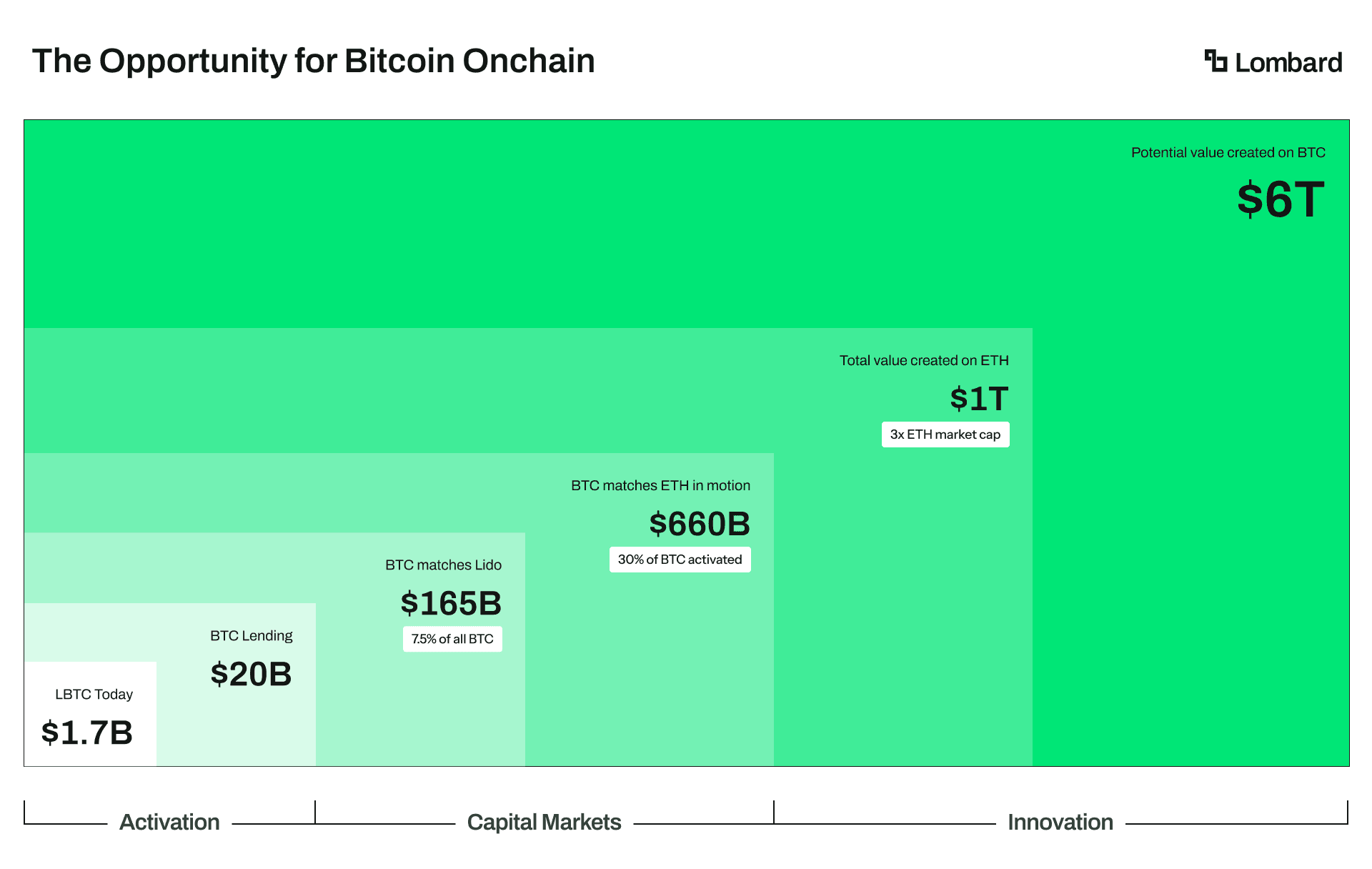

Activation of BTC starts the flywheel. Capital Markets scale the liquidity and utility of BTC. And the result is the development of a full-fledged Bitcoin economy built onchain.

Despite being the first crypto asset, Bitcoin still lacks the liquid onchain market infrastructure needed to give it true utility and velocity — but this is changing!

Activation of BTC starts the flywheel. Capital Markets scale the liquidity and utility of BTC. And the result is the development of a full-fledged Bitcoin economy built onchain.

The opportunity in front of us is transformational — unlocking trillions of dollars in economic opportunity. Here’s the roadmap we’re executing on to bring this vision to life.

Our Three-Phase Roadmap

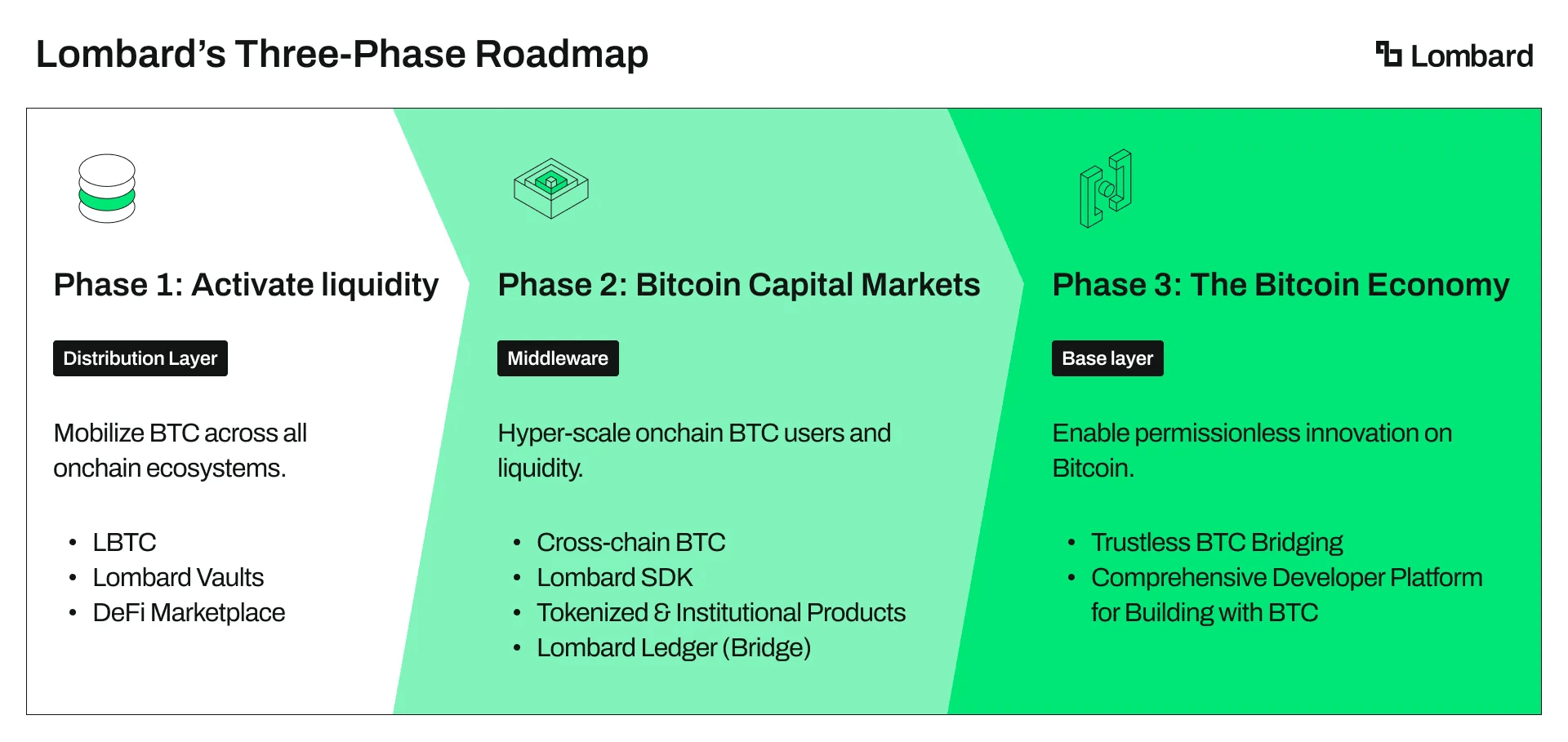

Lombard is building full-stack infrastructure to support Bitcoin Capital Markets onchain. We’re doing so in three distinct phases, each building on the last to create compounding momentum and network effects. In less than a year, we completed Phase 1. We are currently building out Phase 2 (Middleware).

Phase 1: Activate Liquidity

Distribution Layer

Mission: Put every Bitcoin in motion, no matter where or how holders want to use it.

Liquidity is the lifeblood of capital markets and the global economy. To begin bootstrapping onchain markets for Bitcoin, we needed a catalyst.

LBTC was our starting point—a liquid, yield-bearing version of Bitcoin designed with a built-in catalyst for adoption, secured by the leading institutions (Lombard’s Security Consortium).

In under 1 year, LBTC revealed the massive demand for Bitcoin onchain:

- Fastest-growing yield-bearing token in crypto history: $1 billion in TVL in just 92 days, and onboarded over $2 billion net-new liquidity to 12 blockchains.

- Sparked a Bitcoin DeFi renaissance: LBTC inspired leading DeFi protocols—Aave, Morpho, Maple, Pendle, Ether.fi, and EigenLayer—to strategically prioritize Bitcoin integrations, something never done before.

- Unified leading institutions: Lombard’s Security Consortium includes OKX, Galaxy, DCG, Wintermute, Amber Group, Figment, P2P, and more—providing scalable, institutional-grade security for a decentralized Bitcoin primitive.

- Established the playbook for Bitcoin DeFi: Over 80% of LBTC is active in DeFi. Our vault strategies have activated over $600M across new ecosystems. Partnering with Lombard became the single fastest way for chains & protocols to onboard Bitcoin liquidity.

Lombard is and will continue to be the driving force that mobilizes Bitcoin. This is the first step in igniting the flywheel that propels the development of Bitcoin Capital Markets and a sustainable onchain economy.

Phase 2: Bitcoin Capital Markets

Middleware

Mission: Build liquid markets for BTC onchain to enable the next generation of innovation.

Phase 1 revealed clear demand. Phase 2 will hyperscale liquidity & utility for Bitcoin onchain.

Lombard has evolved from a single-product protocol, to offer a suite of Middleware, acting as the connective tissue that links Bitcoin liquidity with any platform, chain, or application.

Lombard’s Middleware for Bitcoin:

- Cross-chain BTC: A simplification of Lombard infrastructure, allowing BTC to be onboarded in wrapped form. The asset will be a neutral public good with permissionless minting & native cross-chain liquidity, ensuring Bitcoin can thrive wherever the best builders are.

- Lombard SDK: Modular developer infrastructure empowering any chain, protocol, or wallet to embed native BTC deposits & yield directly into their applications (the same UX as CEXs, but fully onchain).

- Lombard DeFi Marketplace: A curated 'app-store' interface where BTC holders can explore opportunities to leverage their BTC assets across DeFi, CeFi, and TradFi.

- Lombard Tokenized & Institutional Products: Bridging Bitcoin yield & utility to wherever BTC holders are today. This includes a basis trade vault, tokenized options vault, staked ETF/ETPs, corporate treasury products, and more, in collaboration with leading institutions.

- Lombard Ledger: The leading Bitcoin bridge, secured by 14 trusted digital asset institutions.

Lombard's suite of middleware will scale liquidity by aggregating, not fragmenting, ecosystem resources. We focus narrowly on building the infrastructure that solves Bitcoin-related challenges for ecosystem players, leaving other parts of the stack (ex. execution layer) to those who do it best.

Phase 3: The Bitcoin Economy

Base Layer

Mission: Enable permissionless innovation on BTC.

Onchain economies are unlocking massive value creation by allowing anyone to build on public protocols and primitives: no legal contracts, access controls, or red tape—just technology.

Today, Bitcoin is an asset without an onchain economy. Building on Bitcoin encounters custody complexity, compliance burdens, and trust issues—the same struggles that impede innovation in traditional finance.

Bitcoin Capital Markets in Phase 2 will enable the development of foundational infrastructure designed specifically to support Bitcoin applications and developers in Phase 3.

Base Layer Infrastructure to Support the Bitcoin Economy:

- Open protocol standards that any developer can build upon

- Plug-and-play infrastructure components for settlement, custody, and liquidity

- Trustless BTC bridging to new and existing ecosystems

With the full stack in place, the barriers that have restricted Bitcoin innovation for over a decade will disappear — builders will move at the speed of light. The ripple effects of this will be massive: innovation in the Bitcoin community will flourish (not just for Bitcoin-related businesses), and we will see some of the next big innovations (think: Hyperliquid, EigenLayer, Celestia) come from the Bitcoin community.

More on this to come …

Why Build in Stages?

In crypto, timing is everything. Being early and being wrong are the same. Trying to build the end-state of the Bitcoin economy all at once will not work. Many have tried.

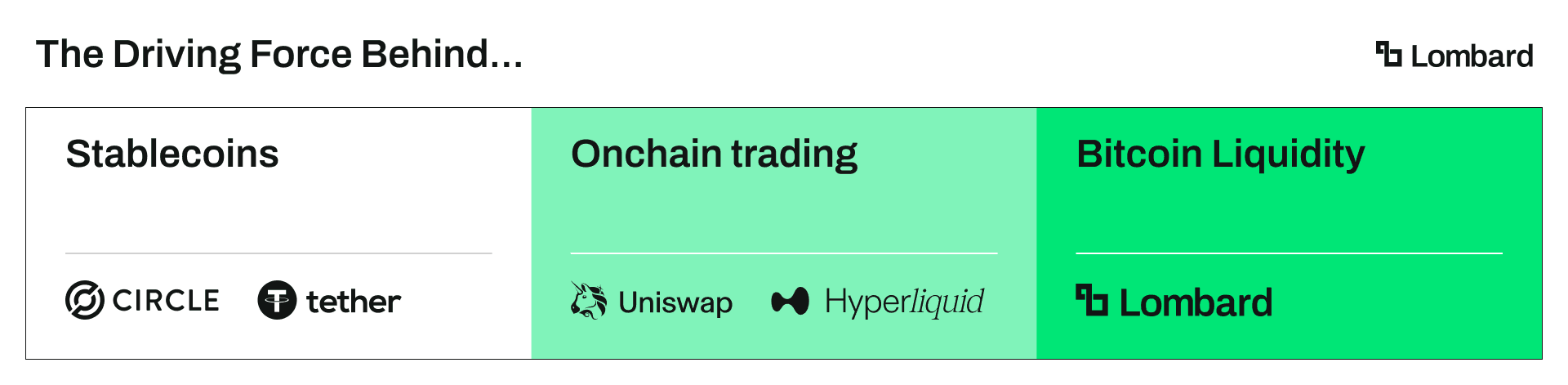

We’re taking a different approach. Rather than building isolated environments for theoretical demand, Lombard integrates its products within established and active ecosystems & applications, creating immediate utility and adoption. We listen to what onchain participants are asking for, and we build infrastructure step by step, meeting Bitcoin holders where they are today. Growth is extremely reflexive, and every category winner (Circle, Tether, Uniswap, HyperLiquid, etc.) has grown in stages.

For Lombard, the journey to build the Bitcoin economy has only just begun. We onboarded $2 billion worth of BTC to DeFi when others said Bitcoiners weren’t ready, and we will continue to push the boundaries of what’s possible—guiding the ecosystem every step of the way.

Lombard is all-in on Bitcoin

Lombard will do for Bitcoin what Tether and Circle have done for stablecoins.

Tether and Circle didn’t just build stablecoin primitives—they were leaders of the movement. Together, they spent years laying the foundation for stablecoin markets onchain. Today, they’ve become two of the most powerful businesses in crypto, owning the liquidity layer for one of the most fundamental assets in onchain finance.

Lombard will be the driving force behind onchain Bitcoin adoption. We're not just building products—we're creating the liquidity flywheels, distribution engines, and onboarding mechanisms that drive industry-wide growth. As we scale, we will educate the market, set the standards, and foster exponential growth for BTC onchain.

Lombard will bring all Bitcoin onchain, no matter how or where you use it. Every Bitcoin holder becomes a potential user. Every protocol becomes a potential partner. Every developer becomes a potential builder.

Our Core Convictions

Our Core Convictions

- Bitcoin and stablecoins will form the base assets of onchain finance. Bitcoin as the foundation for value, and stablecoins as the unit of account. Together, these form the gateway to institutional adoption of onchain finance.

- Onchain finance won't happen on Bitcoin L1. The full lifecycle of using Bitcoin will move off Bitcoin L1 to where programmability and scalability exist. In the short-medium term, this primarily means existing ecosystems. Long-term, trustless environments on Bitcoin will thrive.

- Programmable Bitcoin unlocks permissionless innovation. When developers can build freely with liquid onchain Bitcoin, a new era of financial experimentation begins, enabling endless opportunity.

Building for the Future

At Lombard, we believe a permissionless Bitcoin economy is not just possible—it’s necessary. Every nation, business, and household will soon hold Bitcoin and participate onchain, and Bitcoin will become the foundation of the new financial system.

Lombard’s multi-cycle vision will build the assets and infrastructure to turn this dream into a reality. And in doing so, we’ll pioneer capital markets that enable an economy around the most important asset of our generation.

Bitcoin created the onchain revolution. Now it's time for Bitcoin to lead it.