Everything you need to know about the team building Bitcoin Capital Markets

September 14, 2025

6 minutes read

This post is a welcome to everyone — new and old — to Lombard. It looks back at the what, why, and who of Lombard, and the vision that’s guided us since day one.

With the overwhelming success of the $BARD Community Sale — which brought over 21,000 new members into our journey — now is the perfect moment to reflect on how far we’ve come and share where we’re headed next.

If you’ve just joined us, welcome! Over the past year Lombard has grown from an idea into one of the fastest-moving projects in crypto. For old hands and new members alike, this article is a recap: who we are, why we’re building, and where we’re going next.

Why Lombard Exists

We believe that Bitcoin is the most important asset of our generation. It’s the foundation of crypto, a $2.3 trillion market, and a brand known everywhere. Yet for most of its existence, Bitcoin has been idle capital. At the start of 2024, less than 1% of supply was active onchain.

Meanwhile, assets like ETH and SOL were circulating through lending markets, DEXs, and structured products. Bitcoin, despite its scale, remained isolated from the onchain economy it inspired.

Lombard was created to change that. A team of builders from Coinbase, Polychain, Ripple, Maple, Deutsche Bank, Argent, and beyond came together with one vision: to make Bitcoin liquid and programmable — the financial base layer of onchain finance.

Watch our Livestream with the [leaders of Lombard]. (https://x.com/i/broadcasts/1yoKMoppyeXJQ)

The First Step: LBTC, Lombard’s Yield-bearing BTC

We started with a single product: LBTC, a yield-bearing liquid staked version of Bitcoin. Fully backed, transparently secured, and designed for immediate use in DeFi. The growth was unprecedented:

$1B in deposits in just 92 days — the fastest of any yield-bearing token. $2B+ in liquidity moved from cold wallets into DeFi. 270,000+ holders across 12 blockchains. More than 80% of LBTC actively used in DeFi.

LBTC became the proof point. Bitcoiners do want yield, liquidity, and utility. DeFi protocols do want Bitcoin. The result: Lombard’s yield-bearing BTC is now the leading Bitcoin LST, integrated across Aave, Morpho, Spark, Pendle, EigenLayer, Solana, Sui, Base, Berachain, Sonic, Katana, and more.

Beyond a Token: Evolving the Stack

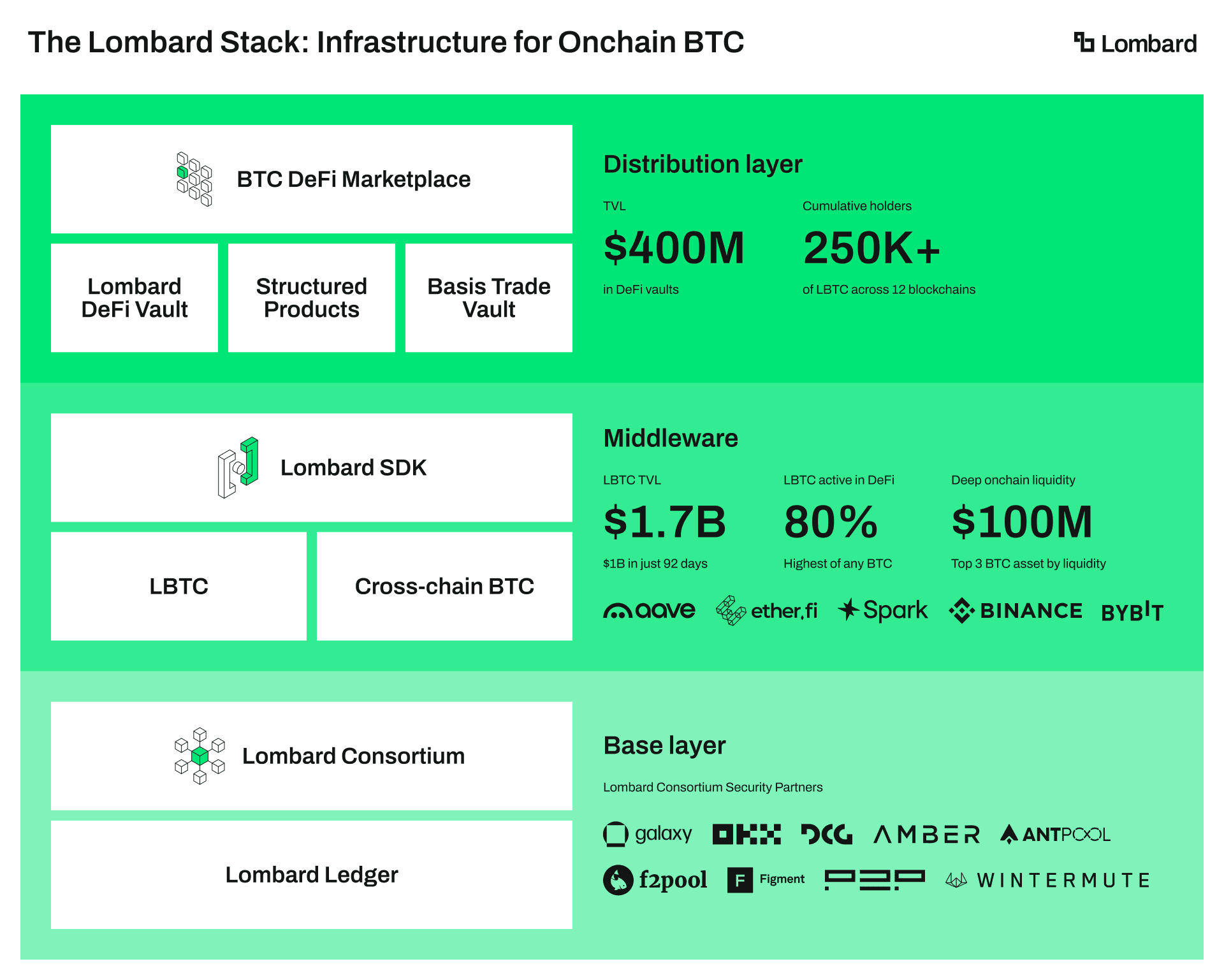

Making BTC yield-bearing was only the beginning. Over the past year, Lombard has expanded into a broader platform — a stack of products and infrastructure that turns Bitcoin from static supply into productive capital.

- Vaults: one-deposit strategies that automate yield across DeFi.

- SDK: already integrated by Binance, Bybit, Figment, and Xverse, bringing one-click Bitcoin staking to millions.

- New BTC assets: eBTC (with Ether.fi) and BTCK (with Katana) extend Lombard’s design to new use cases.

- Lombard Ledger: a BFT-based settlement layer that provides secure bridging for BTC.

And most recently, the Lombard App V2 — rebuilt to make everything a breeze. With a redesigned home and portfolio view, smoother navigation, a dynamic rewards chart, and a refreshed DeFi marketplace, the App is now the “everything hub” for Bitcoin onchain. Whether minting LBTC, swapping, bridging, or exploring vaults, the experience is faster, cleaner, and more intuitive than ever.

Read more about the Lombard App V2.

But these aren’t isolated products. They’re part of a roadmap to build full Bitcoin Capital Markets onchain, which we laid out in our product roadmap blog this summer.

Phase 1: Activate Liquidity (completed). LBTC mobilized $2B+ in liquidity and set the blueprint for Bitcoin DeFi. Phase 2: Build Capital Markets (in progress). We’re scaling utility with cross-chain BTC, vaults, tokenized products, and a curated DeFi marketplace. Phase 3: Enable the Bitcoin Economy (ahead). The long-term goal: open standards and trustless infrastructure that make Bitcoin programmable, with builders free to innovate at scale.

Each new product strengthens the same flywheel: unlocking liquidity, scaling markets, and paving the way for a Bitcoin economy as big as the asset itself. Hear about the product roadmap from the [Lombard team]. (https://x.com/i/broadcasts/1dRKZYMrjprxB)

Source: https://www.lombard.finance/blog/lombard-bitcoin-capital-markets/

Source: https://www.lombard.finance/blog/lombard-bitcoin-capital-markets/

The Community Joins In

Lombard has always been about more than just products. Our community is core to who we are.

This summer, we invited users everywhere to become part of Lombard’s journey through the $BARD Community Saleon Buidlpad. The result was record-breaking:

- $94.7M in commitments.

- 1,400% oversubscribed.

- 133,000+ subscriptions from 132 countries.

- 21,340 participants — making it the most successful raise in Buidlpad’s history.

Read more about the $BARD sale [here]. (https://www.lombard.finance/blog/lombard-attracts-94-7-m-contributions-for-bard-community-sale-on-buidlpad/)

$BARD is more than a token. It secures our infrastructure, unlocks product utility, and governs the protocol through the new Liquid Bitcoin Foundation, which stewards education, growth, and community programs.

Beyond the sale, the community has been shaping Lombard every day. From Lombard Ambassadors and Yappers producing world-class content, to our Bard of the Week spotlights that showcase our community’s grassroots creativity, Lombard is being built with and by its community.

Researching Lombard

Our journey has also been closely followed by independent analysts. Most recently, Four Pillars Research published a deep-dive on Lombard’s first year — analyzing LBTC’s growth, Lombard’s role in shaping Bitcoin DeFi, and our roadmap for Bitcoin Capital Markets. And if you’d like to hear directly from the people behind Lombard, check out this conversation with the team — [where we reflect on our first year, what we’ve learned, and what’s next]. (https://x.com/Lombard_Finance/status/1960353728462021100)

Where We’re Headed

Our work is only just beginning. The first year proved Bitcoin could move. The next phase is about scale.

- Expanding liquidity and utility through vaults, SDK adoption, and tokenized products.

- Building the connective tissue for Bitcoin across chains and ecosystems.

- Enabling a permissionless economy where developers can innovate freely on liquid Bitcoin.

The vision is clear: Bitcoin should be the foundation of global onchain finance.

Looking Ahead

In just one year, Lombard has grown from an idea into:

- The leading Bitcoin liquidity infrastructure provider

- Billions in liquidity onboarded.

- 100+ integrations across DeFi.

- Trusted by institutions, embraced by community.

- 21,000+ new stakeholders through $BARD.

And we’re just getting started.

If you’re new here, you’ve joined at the right time. If you’ve been here since the start, thank you. Together, we’re building the next chapter for Bitcoin.