Through the Babylon Bitcoin Staking Protocol, BTC holders can now delegate stake to secure networks and earn yield. This can be done in two ways: by staking directly with a Finality Provider (FP) via Babylon’s staking dashboard, or by staking through Lombard. The latter issues LBTC— the liquid-staked Bitcoin built by Lombard. Read more about LBTC:

The State of Bitcoin

Bitcoin has long lacked a secure, native way to earn yield—without wrapping, bridging, or giving up control. Capital remained idle. By contrast, Ethereum’s staking participation surpassed 27%, driven by liquid staking protocols like Lido that brought accessibility and DeFi composability to ETH.

Babylon changes that. Its Bitcoin Staking Protocol introduces the first trustless, non-custodial way to stake native BTC and earn rewards.

The Babylon Genesis and Bitcoin Secured Networks (BSNs)

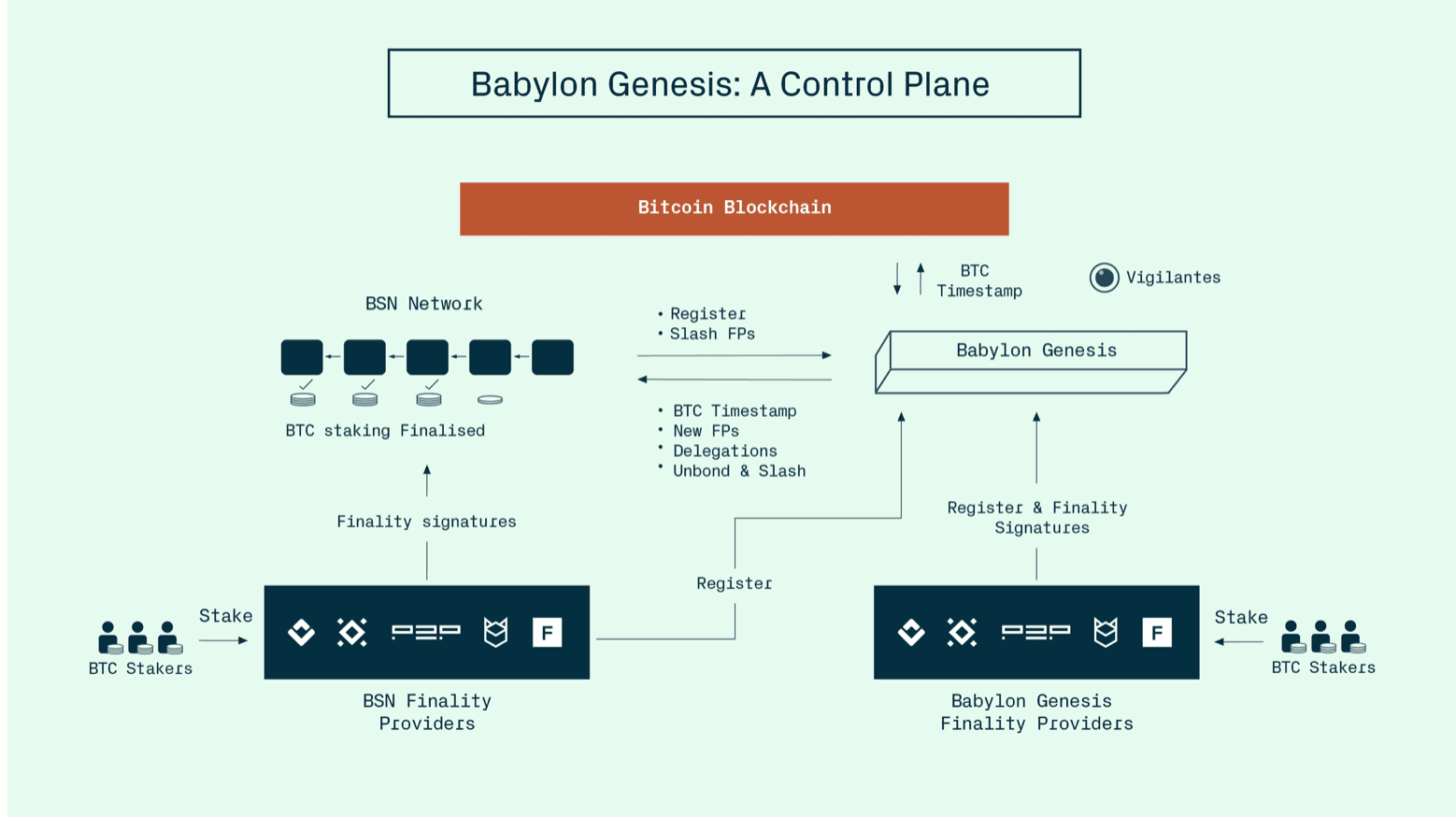

Babylon Genesis is the first blockchain secured by native Bitcoin—marking the launch of a new category: Bitcoin-Secured Networks (BSNs). It introduces a two-sided market where BTC holders and emerging Proof-of-Stake (PoS) networks benefit directly from one another. BTC is staked to secure Babylon and its ecosystem, while BSNs inherit that economic security to strengthen their networks.

At the core of this system, Babylon Genesis coordinates shared security. FPs like Lombard and others enforce integrity by generating cryptographic finality proofs, turning staked BTC into a reusable security asset across modular chains.

Unlike traditional PoS systems that rely on inflationary rewards, Babylon anchors finality to native BTC—secured by a decentralized set of FPs. These FPs—including those operated by Lombard and its Bitcoin Staking Partners—enforce on-chain slashing via UTXO-based conditions, eliminating the need for wrapped tokens or trusted intermediaries.

Source: Babylon

Source: Babylon

Lombard’s Role as a Finality Provider

In Phase 1 of Babylon’s rollout, Lombard operated the largest Finality Provider—securing over 40% of all delegated stake. As Babylon entered Phase 2 with the launch of Genesis and the introduction of permissionless Bitcoin staking, Lombard chose to decentralize rather than concentrate control.

To expand its role and strengthen network resilience, Lombard partnered with four leading institutional staking operators— Figment, Galaxy, Kiln, and P2P —to co-operate four independent Finality Providers. Each partner brings robust infrastructure and deep technical expertise, collectively securing Babylon Genesis and the broader Bitcoin-Secured Network ecosystem.

Read more on the partnership here.

Jacob Phillips, co-founder of Lombard, recently sat down with Lombard’s Bitcoin staking partners to explore the trajectory of BTCFi, Babylon, and the future of decentralized Bitcoin infrastructure. Watch it here.

Stake Bitcoin and Earn Rewards

→ Stake Directly via Babylon

Stake native BTC directly by delegating to a Finality Provider on Babylon.

- No wrapping or tokenization

- Earn BABY rewards

- Fully non-custodial and trustless

Start here: btcstaking.babylonlabs.io

→ Stake via Lombard

Stake BTC through the Lombard App and receive LBTC, the liquid, 1:1 BTC-backed token. Deploy LBTC across 68+ DeFi platforms. Learn more about LBTC:

- Track earned rewards via the Staking Yield Pool

- Stay liquid and access BTCFi

Start here: lombard.finance/app/stake

Lombard enables secure, scalable participation in Bitcoin staking—whether through direct delegation or liquid staking.