Introducing $BARD: The Token Powering Bitcoin Capital Markets Onchain

September 16, 2025

9 minutes read

Bitcoin is the world’s hardest money - but it has yet to reach its full potential. Our mission at Lombard is to unlock that potential by building the foundational infrastructure that brings trillions of dollars of Bitcoin onchain, where it can move seamlessly through the digital economy.

The evolution of finance has always been marked by inflection points, where a single standard unlocked an entire market. CME did it for commodities, SWIFT did it for payments, Tether and Circle did it for stablecoins. The breakthrough wasn’t a single product — it was the infrastructure behind it. By building the rails for better capital mobility, they reshaped finance and became indispensable institutions. Lombard is now carrying that mantle for Bitcoin.

At the centre of this effort is $BARD, the native token of the Lombard protocol. More than just a token, $BARD is an economic coordination mechanism: powering growth, governing the protocol, and enabling access to Lombard’s products and infrastructure.

We’ve designed $BARD with a generational horizon - built to accelerate the development and distribution of Bitcoin infrastructure for decades. As Lombard scales, the vision is simple: every Bitcoin holder becomes a user, every institution a client, every protocol an integration partner, and every developer a Bitcoin builder.

Core Token Utilities

$BARD is the key to participating in Lombard’s ecosystem. $BARD is designed to serve four core purposes:

1. Governance

$BARD is the backbone of Lombard’s governance layer, empowering a robust and engaged community to steer the protocol’s evolution. Holders will shape critical decisions - from validator set composition and fee structures to product roadmaps and the allocation of ecosystem grants through the Liquid Bitcoin Foundation (LBF).

2. Security

$BARD plays an active role in securing Lombard’s core infrastructure. At launch, holders will be able to stake $BARD to safeguard cross-chain transfers of LBTC, built on top of Chainlink’s CCIP and Symbiotic infrastructure. This creates a decentralized security layer that scales with protocol adoption.

3. Ecosystem Development

$BARD is the catalyst for Lombard’s network effects, channeling resources to accelerate adoption and expand the protocol’s reach. Through the Liquid Bitcoin Foundation (LBF), $BARD holders can fund ecosystem grants, forge commercial partnerships, and support cutting-edge research and development. These efforts ensure that Lombard’s infrastructure not only scales but continually evolves, unlocking trillions in economic opportunity and cementing Bitcoin’s role at the core of onchain finance.

4. Lombard Protocol Utility

From day one, it enables holders to access and participate in Lombard’s growing suite of products—offering priority access, preferred terms, and enhanced functionality across the ecosystem. Over time, utility will expand through governance-driven innovation, ensuring $BARD remains central to every layer of Lombard’s infrastructure and product suite.

Token Distribution

Lombard’s mission is to bring Bitcoin onchain—and at the heart of that mission is establishing sustainable economics for the entire ecosystem. The design of $BARD’s utility and distribution has been carefully structured to align with this vision and our core principles.

We believe $BARD’s allocation embodies fair value distribution, driving powerful network effects and supporting long-term, sustainable growth across the ecosystem in the months and years ahead.

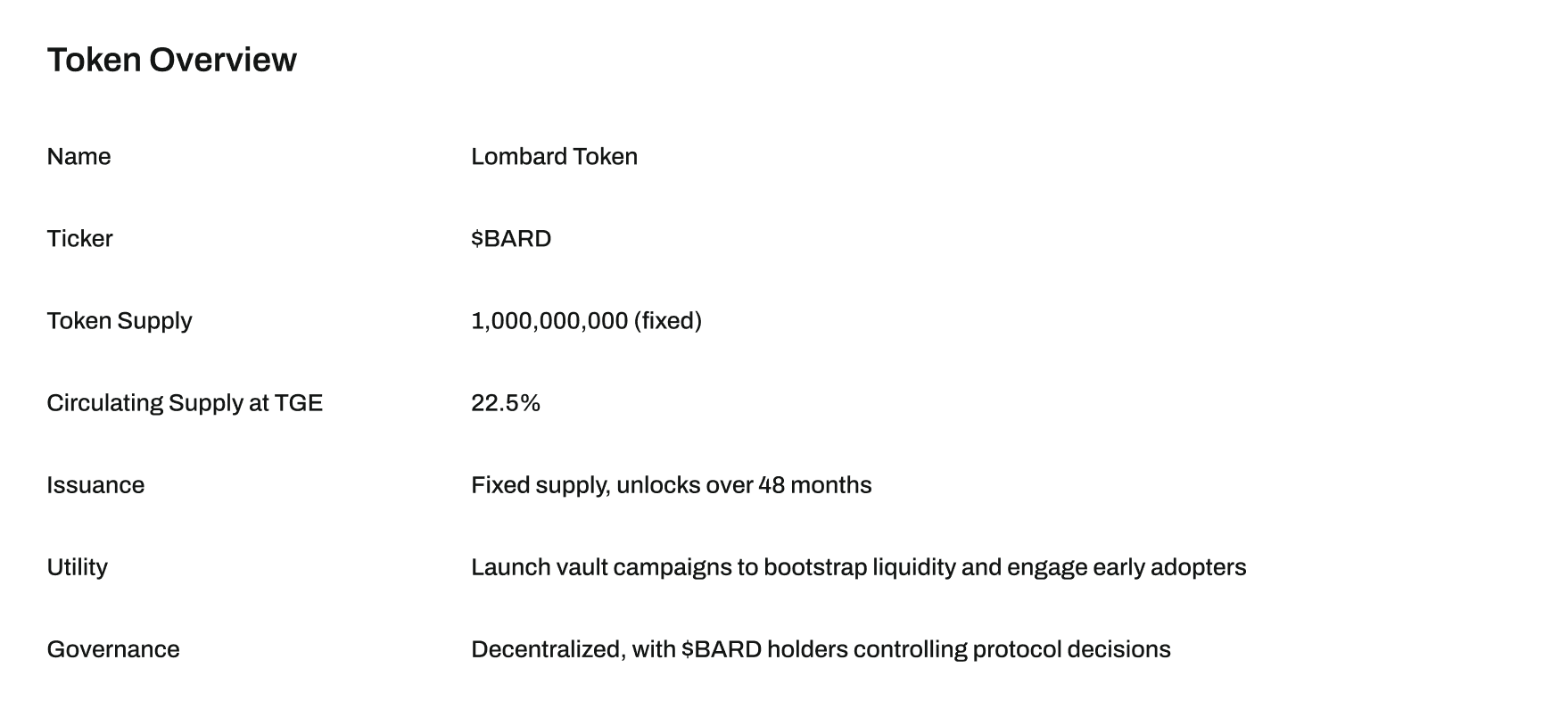

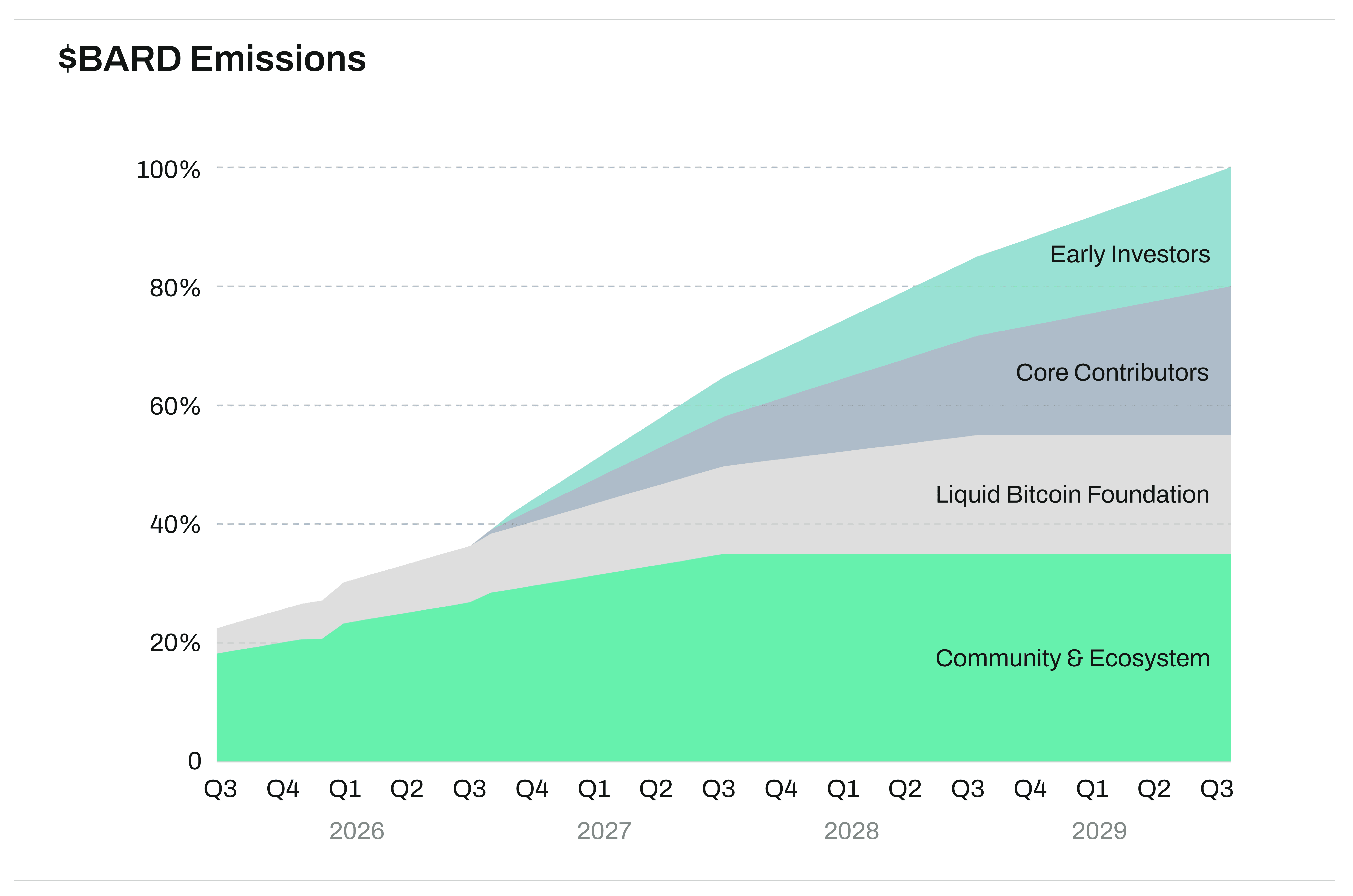

The total token supply is fixed at 1,000,000,000 $BARD at TGE. At launch, 22.5% (225,000,000 BARD) will enter circulation to reward early users and participants, providing liquid incentives that accelerate near-term ecosystem growth. The remaining supply will unlock gradually over a 48-month period post-TGE, designed to align stakeholders and ensure Lombard’s long-term, sustainable development.

The $BARD reserved for Ecosystem Activation and Development is unlocked as follows:

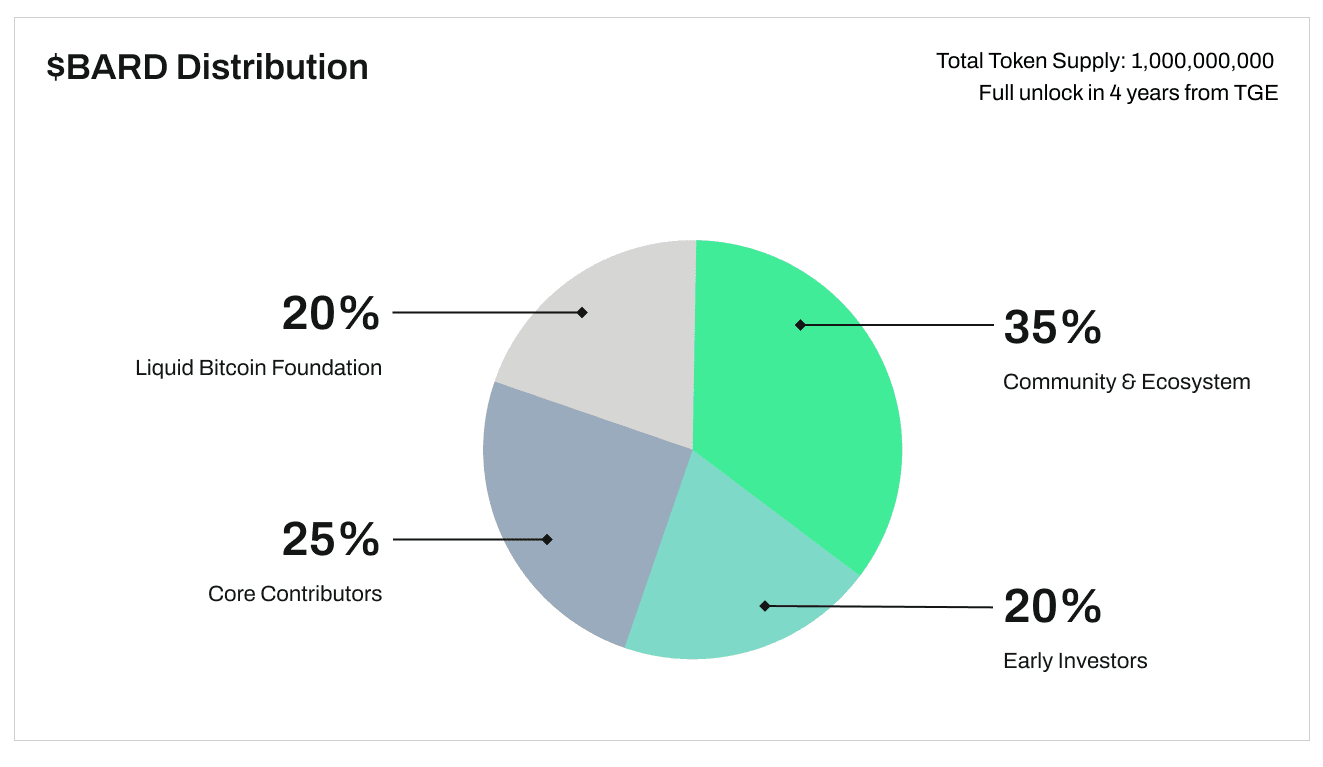

Ecosystem (35%)

Over one-third (350,000,000 BARD) of the total token supply is dedicated to community growth, ecosystem development, and public participation, reflecting our deep commitment to growing with our community and users.

-

Airdrop Season 1 (4%): Early users receive tokens equal to 4% (40,000,000 BARD) of the token supply. 1.5% is distributed at TGE, 1.5% is distributed 6 months post-TGE, and 1% is distributed 12 months post-TGE. Full details and eligibility criteria can be found here: https://docs.lombard.finance/frequently-asked-questions/bardairdropfaq#eligibility

-

Ecosystem Activation (11%): 11% of the token supply (110,000,000 BARD) is unlocked immediately and dedicated to direct distribution to users via incentive programmes and campaigns.

-

Airdrop Season 2 (1.5%) : As part of Ecosystem Activation, the Lux program continues post-TGE as a 6-month-long Season 2, where new and existing users will continue to earn Lux and be eligible for the Season 2 Airdrop. The Season 2 allocation of 1.5% of the total token supply will be fully unlocked and available to claim shortly after the end of Season 2.

-

Kaito Yappers (0.16%): As part of Ecosystem Activation, Lombard initiated a year-long Kaito Leaderboard campaign to drive Lombard’s mindshare and grow its community. The total allocation is 0.16% of the token supply and will be distributed across 2 seasons.

-

-

Community Sale (1.5%): At Lombard, we believe that communities, not just institutions, should have access to the earliest and most consequential opportunities in crypto. Our pre-launch Community Sale of $BARD raised $6.75 million at a $450 million FDV from 21,340 verified participants from 132 countries worldwide. Hosted by Buidlpad, all allocations are fully unlocked at TGE.

-

Ecosystem Development (18.5%): 18.5% (185,000,000 BARD) is reserved for long-term ecosystem development. The unlocked portion of the Ecosystem Development bucket is equal to 4.25% (42,500,000 BARD) of the total token supply; the rest (14.25%) will unlock linearly over 24 months. Ecosystem development tokens will fuel ecosystem growth primarily through commercial partnerships to further solidify Lombard’s marked dominance in Bitcoin infrastructure.

Liquid Bitcoin Foundation (20%)

The Liquid Bitcoin Foundation serves as the steward of the Lombard Protocol, mandated to advance both commercial initiatives and public good efforts that expand the Lombard ecosystem. To fulfil this role, one fifth of the total supply (200,000,000 BARD) has been allocated to the LBF, empowering it to fund research, development, and initiatives that enhance Lombard’s product suite and technical architecture. Of this allocation, 4.25% (42,500,000 BARD) of the token supply will be unlocked at TGE, and the remaining 15.75% (157,500,000 BARD) will be released linearly over three years. The LBF retains flexibility to direct unlocked tokens toward ecosystem opportunities as needed, ensuring resources are deployed where they can create the greatest long-term impact.

The LBF retains flexibility to direct unlocked tokens toward ecosystem opportunities as needed, ensuring resources are deployed where they can create the greatest long-term impact.

Early Investors (20%)

To catalyze Lombard’s vision, we secured backing from leading global investors, including Polychain, Franklin Templeton, and YZi Labs (formerly Binance Labs). Their capital and conviction have been instrumental in enabling the technical development, infrastructure build-out, and early market leadership required to establish Lombard at scale. Early investors have been allocated 20% of total supply (200,000,000 BARD), subject to a 48-month lock-up, with linear unlocks commencing 12 months post-TGE. This structure underscores long-term alignment between Lombard, its backers, and the broader ecosystem.

Core Contributors (25%)

Our mission to build Bitcoin Capital Markets onchain requires industry-leading talent and attracting that talent requires long-term incentive alignment. As such, we’ve allocated 25% of the total supply (250,000,000 BARD) to incentivize current and future core contributors. Core Contributor tokens are subject to service-based vesting subject to a 48-month lock-up, with linear unlocks commencing 12 months post-TGE.

Future Lombard Protocol Fee Model

The Lombard Protocol can capture fees across the product suite by way of mint and redeem fees, vault fees, and transaction fees on the Lombard Ledger and the Lombard SDK. As demand for Bitcoin products and services accelerates, Lombard is positioned to become the middleware and infrastructure layer for businesses, supported by structured payment models and scalable fee streams. A short overview of each is provided below.

LBTC Staking Yield

Lombard earns a share of yield from operating Finality Providers on Babylon’s Bitcoin Staking Protocol. Today, fees are being generated on $1.5 billion of staked BTC backing LBTC.

Vaults

Vaults integrated with Lombard generate management fees and may include performance fees on yield. To date, more than $750 million has been deposited across multi-chain and ecosystem vaults. Lombard plans to expand its yield product suite to create opportunities for both CeFi and TradFi participants.

Mint and redeem fees on assets

Future upgrades may introduce mint and redeem fees on LBTC. To date, over 29,020 BTC ($3.3B) has been minted, with $1B redeemed. In Q4, Lombard will launch a new permissionless Bitcoin wrapper using LBTC’s architecture, but without Babylon staking. This yieldless asset is designed for trading and creates a new avenue for fee capture.

Transaction fees on the Lombard Ledger and Lombard SDK

The Lombard Ledger, a Proof-of-Authority Layer 1 for secure Bitcoin settlement, provides long-term potential to capture transaction fees as developer activity scales. The Lombard SDK, already integrated by Binance, Bybit, and others, has facilitated the minting of more than 2,000 BTC. Future revenue-sharing models with partners may provide additional upside.

Looking ahead, as Lombard expands its product suite and integrates more deeply with financial institutions, neobanks, and fintechs, we anticipate the establishment of structured payment models. Ranging from per-transaction fees to recurring subscriptions, all for access to Lombard infrastructure.

Future Buyback Program

As protocol fees grow, the Lombard Protocol will introduce a structured buyback program designed to reinforce long-term alignment with the stakeholders building and supporting the ecosystem. This mechanism will serve as a cornerstone of value distribution. This will tie protocol success directly to stakers, creating a sustainable feedback loop, and fostering a durable, engaged community as adoption scales.

Lombard’s tokenomics have been deliberately engineered to reward early believers, align long-term stakeholders, and fund the development of critical Bitcoin infrastructure for decades to come. This is only the beginning - and we invite you to help build the future of onchain finance.

Important Disclaimer

The content here is intended for informational purposes only. Nothing herein shall be construed as an offer to sell, or the solicitation of an offer to purchase any digital assets or an offering, advertisement, solicitation, financial promotion, invitation or inducement to engage in any investment activity. Participation in BARD token airdrop will be subject to additional terms and conditions.

This crypto-asset marketing communication has not been reviewed or approved by any competent authority in any Member State of the European Union. The offeror of the crypto-asset is solely responsible for the content of this crypto-asset marketing communication.