1 Year of Lombard: From Bitcoin LST Leadership to Building Bitcoin Capital Markets

September 14, 2025

15 minutes read

This blog reflects on Lombard’s first year. From the launch of LBTC and the subsequent rise of onchain Bitcoin liquidity, to the vaults, products, and partnerships that have seen Lombard become a driving force for Bitcoin onchain. It also looks ahead at the assets, products and infrastructure that we’re building to cement Lombard’s future, expand our ecosystem, and serve a broader user base.

Bitcoin is the most important asset of our generation, with a $2.3 trillion market capitalization, a global brand recognized in every household and organization, and an irreverent mission to disrupt global finance as we know it. Yet for most of its history, Bitcoin has remained economically underutilized.

At the start of 2024, less than 1% of Bitcoin’s supply was onchain in the form of wrapped BTC assets. 99% of the total BTC supply sat dormant, held in cold storage, doing nothing.

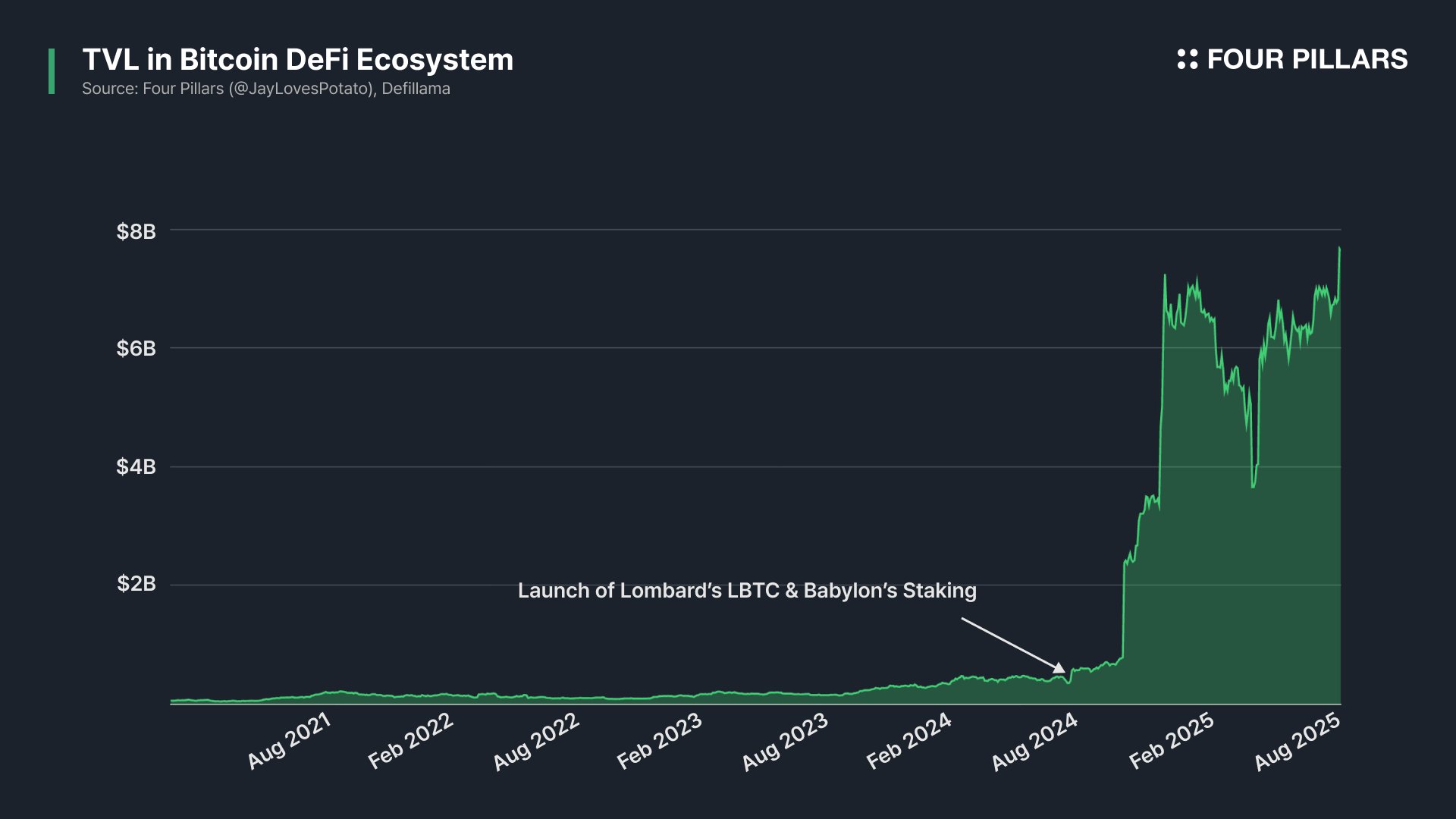

According to DeFiLlama, Bitcoin DeFi’s TVL was even lower at below $500 million. Across the blockchain ecosystem, assets of far smaller market caps like $ETH and $SOL were being cycled through lending markets, liquidity pools, derivatives, and yield strategies. Bitcoin, despite its scale, was contributing little to the onchain economy it inspired 16 years ago.

At the same time, institutional adoption began to accelerate. Bitcoin ETFs became the most successful launches ever, and institutions began building regulatory-compliant custody frameworks and structures allowing them to move beyond simple products like trusts and ETFs and into natively staked tokens and other onchain instruments (e.g., 21Shares’ Ethereum Staking ETP, stETH custody support by Galaxy’s subsidiary GK8, the recognition of stETH as collateral in options and structured product trading on Caladan, etc).

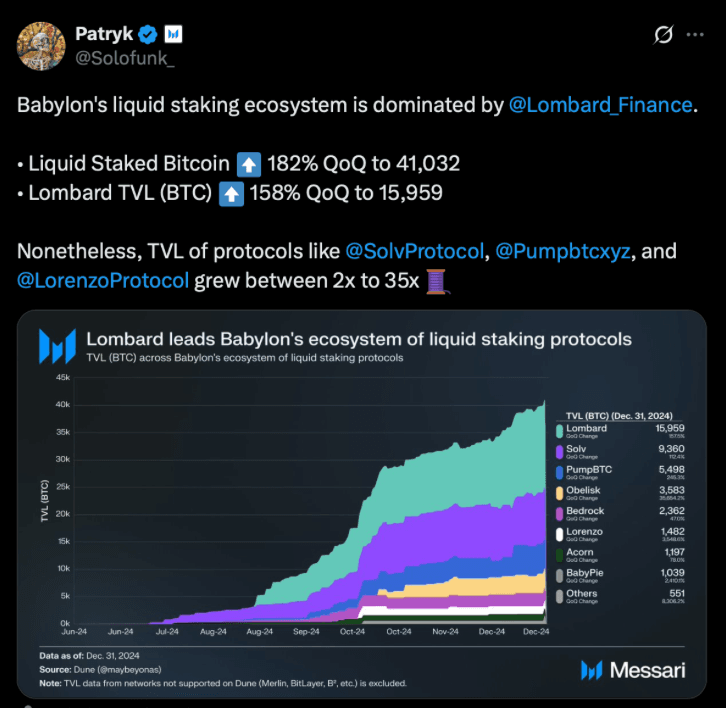

With almost perfect timing, Lombard was established to awaken Bitcoin’s dormant liquidity, not through another sidechain or centralized wrapper, but with a simple idea to connect Bitcoin to DeFi, which saw the launch of the leading Bitcoin LST, $LBTC. Today, as of August 2025, there is around $7.5 billion bitcoin in DeFi, an increase of around 1,400% in just one year.

1,400% growth is clear proof of the demand to do more with Bitcoin. This growth shows that Bitcoin’s true home is onchain, and that all it needed was a driving force. Yet even today, only 1.5% of total BTC supply is active onchain, leaving a vast opportunity ahead.

Lombard is building for that future — evolving from issuing a single asset, to deliver against a full roadmap of products and infrastructure designed to serve both individuals and institutions, in order to drive Bitcoin liquidity onchain at scale.

Building What Bitcoin Needed

Lombard’s founding insight was simple but uncompromising: Connect Bitcoin to DeFi - rather than building on an L2 or sidechain. By integrating BTC directly into the protocols users already use would give DeFi power users another asset to utilize in existing strategies and drive immediate adoption.

Lombard’s foundational blocks combined:

- Backed by the Best: Polychain Capital incubation and $16M seed financing from institutional and strategic investors including FTI Global, YZI Labs, Bybit and more.

- Team Expertise: A team drawn from Coinbase, Argent, Ripple, Maple Finance, and Deutsche Bank, with expertise spanning security engineering, DeFi market design, and institutional capital markets.

LBTC: The Breakthrough

In August 2024, Lombard launched $LBTC, the first institutional-grade, yield-bearing Bitcoin asset, fully-backed by BTC and free to compose throughout DeFi, allowing allocators to utilize and grow their BTC holdings while retaining core exposure to the asset. The adoption curve was unprecedented:

- Growth: $1 billion TVL in just 92 days. Faster than any other yield-bearing token in history, including Lido’s stETH and Ether.fi’s eETH.

- Movement: $2+ billion in net-new liquidity unlocked from cold storage into DeFi.

- Adoption: 270,000+ holders across 12 blockchains, from Ethereum mainnet to Base, Sui, BNB Chain, and beyond.

- Market Leadership: Ranked the 4th largest BTC derivative globally — and by far the largest yield-bearing BTC asset with 57% market share.

- 100+ DeFi integrations: Over 80% of $LBTC deployed directly into active DeFi — lending markets, liquidity pools, and restaking protocols — with $735 million in lending strategies alone.

For Bitcoin holders, $LBTC unlocked a new prime-collateral: a liquid, yield-generating Bitcoin asset with predictable BTC-denominated returns, backed by a decentralized validator network, with transparent reserves, and ready to be used across lending, trading, and yield strategies.

"Bitcoin doesn’t need to leave the Bitcoin network to become productive," says Drake Breeding, Head of Institutional Partnerships at Figment. "$LBTC lets you unlock rewards while preserving everything you value."

Go-to-Market Success

A key driver behind this growth was Lombard’s $LBTC Go-To-Market Strategy — a repeatable playbook designed to ensure instant utility and immediate adoption wherever $LBTC launched. Each blockchain integration was selected where there was real demand for BTC in DeFi, ensuring LBTC could solve an immediate liquidity gap. The launch model was simple but effective:

- Deploy $LBTC on the new chain.

- Activate all major DeFi protocols on Day 1, from lending markets to liquidity pools.

- Turn on incentives immediately to drive adoption from the start.

This coordinated approach ensured that $LBTC wasn’t just another wrapped token arriving with no use case, or liquidity — it was active from the moment it hit the chain. Over time, this became the playbook for all Bitcoin asset launches, adopted as the standard for how to bring BTC liquidity into new ecosystems.

“$LBTC gives Katana users a secure, yield-ready Bitcoin asset that slots directly into core DeFi apps like Morpho, Sushi, and Yearn creating immediate, productive TVL for the ecosystem. Seeing $LBTC liquidity go live on Katana and immediately integrate into core lending and DEX markets was a standout moment, and we are ready for more” - Justin Havins, DeFi Lead, Katana.

Over the past year, multiple new BTC wrappers, including cbBTC and XBTC, entered the market. But unlike these entrants, $LBTC is a Bitcoin LST, just like stETH, with native yield, permissionless access, and a non-centralized asset issuer, a combination that has kept it at the forefront of users minds.

Four Pillars Research also situates this growth in the wider ‘BTCFi trend’: Bitcoin DeFi’s TVL expanded from under $500M in early 2024 to around $7.5B today, with ovee 82% of $LBTC active in DeFi totalling around $1.2B. But unlike centralized wrappers like $WBTC or $BTCB, $LBTC “circulates in a decentralized and permissionless environment while inheriting Bitcoin’s security guarantees.”

Partners helped ensure $LBTC’s security, transparency and growth: Chainlink and RedStone delivered real-time Proof of Reserves and Price Feeds. Figment, Kiln, P2P, and Galaxy operated Finality Providers on Babylon. Binance, Bybit, Figment and Xverse integrated the Lombard SDK, bringing one-click staking to millions.

Veda built Lombard’s Vaults that automate $LBTC deployment across DeFi, aggregating APY, ecosystem rewards, and rebalancing strategies with a single deposit. Babylon provided the destination for the BTC underlying $LBTC to be staked to earn a yield.

"LBTC by far has been becoming the standard for yield on Bitcoin that can be used in DeFi across dozens of chains," says Marcin Kazmierczak, Co-Founder of RedStone, which partnered with Lombard to build the first real-time Proof of Reserves system for a Bitcoin LST and maintain Lombard’s price feeds.

Security as Strategy

If yield was the hook, security was the foundation. Lombard designed its protocol to meet — and in many ways exceed — the security expectations of the most conservative Bitcoin holders.

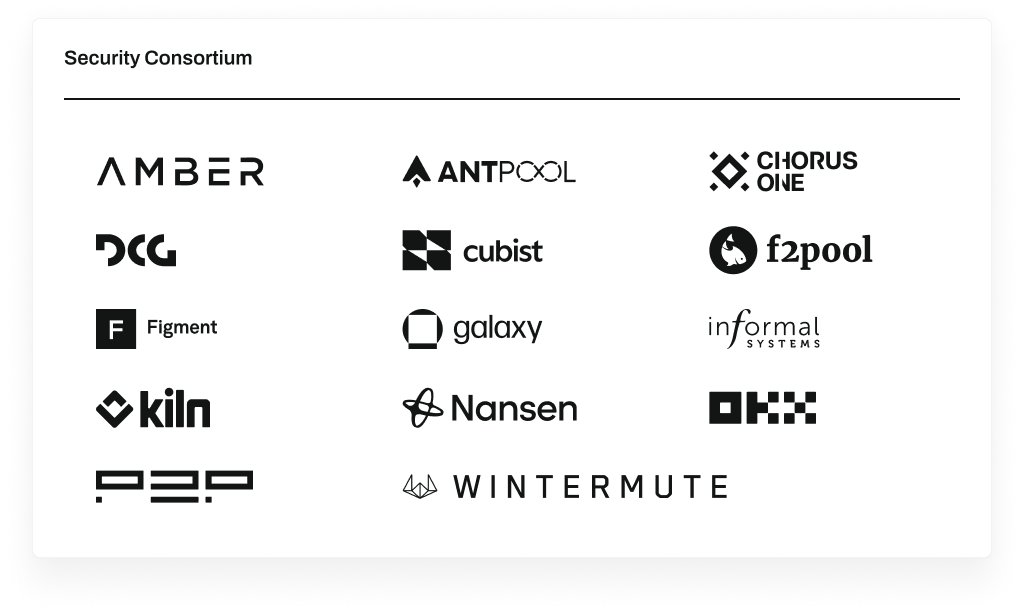

The Lombard Security Consortium unites 14 of the largest institutions in digital assets — including Galaxy, DCG, OKX, Wintermute, Amber Group, Antpool, and F2Pool — to collectively safeguard user deposits. Multiple independent checks and balances, hardware-enshrined contracts, multi-factor approvals, timelocks, and off-chain governance policies ensure no single entity can act unilaterally. As Four Pillars Research observed: “The stigma of BTC bridges has long deterred institutions. Hacks and poor custody models created fear. Lombard’s approach — consortium-level governance, hardware-isolated keys, and live proof of reserves — represents the first institutional-grade standard for moving BTC onchain.”

Cubist, a security firm led by Carnegie Mellon, Stanford and University of California-San Diego professors, serves as an advisor on key management and bridging security. As Ann Stefan, Co-Founder of Cubist, puts it: "Lombard is the protocol that takes security seriously, working to release new products without giving up on this core principle."

Since launch, Lombard has maintained zero security breaches, and uninterrupted redeemability for native BTC. This stability is supported by over $150 million in DEX liquidity, partnerships with leading market makers, and Lombard’s pioneering real-time Proof of Reserves oracles built with both RedStone and Chainlink.

“The market has long lacked a universally accepted, trust-minimized standard for moving BTC securely into programmable environments,” John Mulreany of Kiln noted. “Historically, hacks and thefts created stigma. Lombard is proving Bitcoin can be brought onchain without sacrificing safety.”

Key engineering and security achievements over the past year include:

- Cross-chain interoperability: Chainlink CCIP integration, enabling secure transfers of $LBTC and other BTC primitives across ecosystems.

- Institutional-grade audits: Multiple independent code reviews by Veridise, Halborn, and other top security firms.

- Proactive threat monitoring: Real-time anomaly detection via Hexagate, supported by a multi-RPC architecture for redundancy.

- Ongoing security incentives: Evergreen bug bounties on Immunefi, with active whitehat engagement and issued rewards.

- Track record of resilience: Zero security incidents since inception.

As Four Pillars underlined in their research, “the expanded ecosystem is safeguarded on both security and governance fronts… transactions are approved through the consortium, key management is hardware-isolated, and financial soundness is verified in real-time.”

The result: zero breaches, uninterrupted redemptions.

Catalyst for Bitcoin DeFi

Lombard’s impact went far beyond its own TVL. By proving that secure, yield-bearing Bitcoin could exist in liquid form, it pushed the entire DeFi ecosystem to prioritize Bitcoin integrations for the first time.

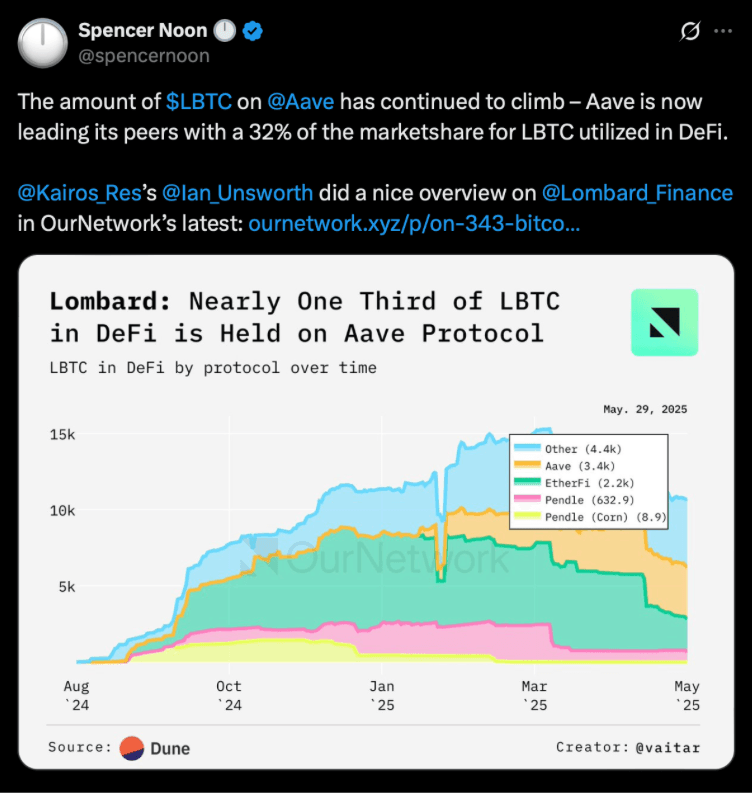

In 2024–2025: Aave, Morpho, Maple, Spark, Pendle, Ether.fi, EigenLayer — all integrated $LBTC after thorough risk reviews by risk curators such as Chaos, Gauntlet, RE7, MEV, BGD, Llamarisk, and BlockAnalitica and comprehensive governance processes. $600M+ flowed into new ecosystems through $LBTC Vault strategies on Berachain, TAC, Sonic, and Katana.

Lombard Ecosystem. Source: Four Pillars

Lombard Ecosystem. Source: Four Pillars

“As Lombard's vault partner, the vault product line has been the most impactful. Bitcoin is the largest asset by market cap and one where the demand will only increase. For Veda, it's critical to align with blue chip teams in this category, and Lombard is one of those teams.” - Stephanie Vaughan, Co-founder, Veda

Expanding the Product Stack

LBTC was just the starting point. Over the past year, we have expanded into a suite of Bitcoin liquidity and security primitives:

- eBTC — The first restaked Bitcoin product, launched with Ether.fi.

- BTCK — A wrapped Bitcoin asset developed for Katana, designed as a permissionless BTC wrapper.

- Lombard Ledger — A Cosmos BFT-based consensus layer for secure Bitcoin settlement.

- Lombard Vaults — Yield products leveraging $LBTC and other BTC assets across multiple ecosystems.

- Lombard SDK - A developer ready toolkit enabling exchanges, wallets, and institutions to offer Bitcoin staking to their users simply and securely.

Binance, Bybit and Figment were early to integrate the Lombard SDK into their Web3 wallets, making one-click Bitcoin staking available to millions of exchange users.

"The Lombard SDK has allowed us to integrate $LBTC with some of our closest partners and customers, bringing the benefits of liquid staked Bitcoin to BTC holders everywhere," says Drake Breeding of Figment.

Brand Evolution

Lombard began with the rallying cry of “Connecting Bitcoin to DeFi”. By mid-2025, the positioning evolved: Pioneering Bitcoin Capital Markets.

This shift reflects both the company’s expanding product stack and its growing role as infrastructure for the entire Bitcoin economy. The visual identity was refreshed, the website rebuilt, and global expansion accelerated.

Under the hood: Lombard’s Rebrand in 2024

In parallel, Lombard built a strong presence of Lombard in the wider ecosystem -

Shaping the Market Conversation

- Presence at flagship events — Token2049, Korea Blockchain Week, Permissionless, Cosmoverse — positioned Lombard as a category-defining voice.

- Thought leadership on BTC capital markets and onchain adoption, published with Messari and Kairos Research, reinforced credibility.

- 300+ media features, including Coinbase, The Block, Messari and others timed with launches and partnerships to solidify Lombard’s position as the category leader. Building the Movement

- Community: 70K+ followers on X, 35K Discord members, 6,000+ in-person event attendees.

- Launched the Ambassador Program with Lombard’s earliest community members

- Campaigns: Product waitlists, Binance Earn and the Kaito Yapper Leaderboard.

- User growth: 270K+ LBTC holders across 12 blockchains in just one year.

A Deliberately Nimble Team

Operating remotely across the globe, the Lombard team only grew from 20 to 25 in 12 months — remaining lean,nimble and execution-driven. Regular offsites in Miami, Bangkok, Mexico, Dubai, and Hong Kong bring the team together to work in person.

The result: a brand that’s not just a visual identity but a market position — one that leads the conversation, sets the standard, and mobilizes adoption across the Bitcoin ecosystem.

Research-Backed Growth

Lombard’s rise has also been documented extensively by independent analysts and research firms, without paid promotion. From deep-dive market reports to protocol benchmarking, publications like Messari, and Kairos Research have highlighted Lombard’s expanding market share, adoption curve, and role in shaping Bitcoin’s onchain economy.

Most recently, Four Pillars Research published a deep dive into Lombard’s first year. The report analyzed how LBTC became the leading Bitcoin LST, driving adoption across 13 chains and 70+ protocols, and outlined Lombard’s three-phase roadmap — from activating liquidity, to building capital markets, to enabling a full Bitcoin economy. Their conclusion: Lombard is positioning itself as the foundational layer for a future where Bitcoin is not just a store of value, but the base collateral for global onchain finance.

The Road Ahead: Building Bitcoin Capital Markets

The future Lombard is building toward replaces isolation with integration, turning Bitcoin into the base collateral for the onchain economy.

The plan, announced in July 2025, unfolds in three deliberate phases:

- Activate Liquidity — Completed with LBTC’s launch, mobilizing over $2B in dormant BTC and establishing the security, liquidity, and trust architecture.

- Build Capital Markets — In progress, delivering the middleware that connects Bitcoin liquidity to every environment where it can be productive. A new permissionless BTC wrapper, new scalable vaults, and an expanded DeFi marketplace are central to this stage.

- Enable the Bitcoin Economy — The long-term objective: a permissionless environment where developers can deploy new financial primitives on top of liquid, programmable Bitcoin without custody or interoperability barriers.

This phased approach is intentional. Lombard builds into existing demand rather than creating isolated, supply-driven systems. Each layer amplifies the next — liquidity enabling markets, markets enabling economies.

The end-state is a Bitcoin economy that matches the scale of its asset: trillions in value, fully integrated into global onchain finance.

Image

$BARD: The Native Token of the Lombard Protocol

Lombard recently announced $BARD, its native token, with three core roles:

- Security — staking to secure LBTC, Lombard Ledger, and protocol infrastructure.

- Utility — discounts and early access to products.

- Governance — voting on proposals, fee structures, and Liquid Bitcoin Foundation grants.

Alongside $BARD, Lombard launched the Liquid Bitcoin Foundation —an independent steward of the Lombard Protocol—the infrastructure enabling Bitcoin Capital Markets onchain. Distribution reflects Lombard’s community-first ethos. A $6.75M Community Sale on Buidlpad giving users, Lux holders, and content creators access to early allocations.

Four Pillars Research noted: “For Bitcoin to underpin capital markets, governance and distribution at scale are critical. $BARD and the Liquid Bitcoin Foundation directly address these requirements.”

As Erick Zhang, Founder of Buidlpad, said: “Lombard is unlocking Bitcoin’s full potential as digital gold and a foundation of next-gen capital markets. By connecting Lombard with real communities and putting them first, we drive the next wave of Bitcoin adoption together.” The Road to 2030

If year 1 was about proving Bitcoin could be productive without sacrificing security, year 2 and beyond are about building comprehensive Bitcoin capital markets — spanning lending, derivatives, cross-chain liquidity, and settlement infrastructure.

As Four Pillars summarized: “The awakening of Bitcoin’s dormant liquidity and the realization of genuine BTCFi are likely to be led by Lombard, which is rapidly constructing a full-stack, Bitcoin-centered ecosystem.”

By 2030, industry leaders expect Bitcoin to become the dominant global collateral asset: "Bitcoin will be the beating heart of DeFi, with utilization far outstripping Ethereum," predicts Alexei Zamyatin, Co-Founder of BOB.

"By 2030, Bitcoin will have evolved from a static store of value into a cornerstone of programmable, permissionless finance," adds Alex Ausmus of Sui Foundation.

Lombard proved in one year what the industry had speculated about for over a decade: that Bitcoin could be both secure and productive. The next chapter is about making it indispensable to global finance.

Further reading:

Lombard announces $BARD and the pre-launch community sale

About the Liquid Bitcoin Foundation

Lombard’s Roadmap to build Bitcoin Capital Markets onchain

About LBTC, Lombard’s yield-bearing Bitcoin LST

Important Disclaimer The content herein is provided for information purposes only. No information contained here constitute, or should be construed as, an offer to sell, solicitation of an offer to buy, or recommendation to subscribe for, any tokens or financial products. Participants are responsible for conducting their own independent research, due diligence, and assessment of the suitability and risks of participating, including obtaining professional advice they deem necessary. Neither Lombard Finance Ltd., Liquid Bitcoin Foundation, Liquid Bitcoin Operations (collectively, “Lombard”) nor Buidlpad, nor any of their respective affiliates, directors, officers, employees, or agents, accepts any liability whatsoever for any loss or damage arising directly or indirectly from any reliance on the information provided herein or from participation in the Community Sale, except to the extent required by applicable law.